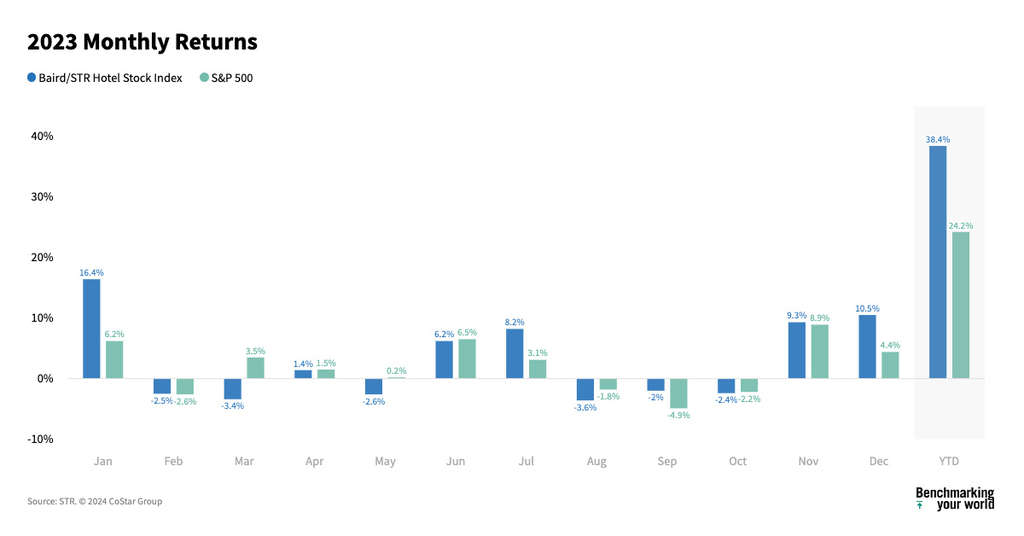

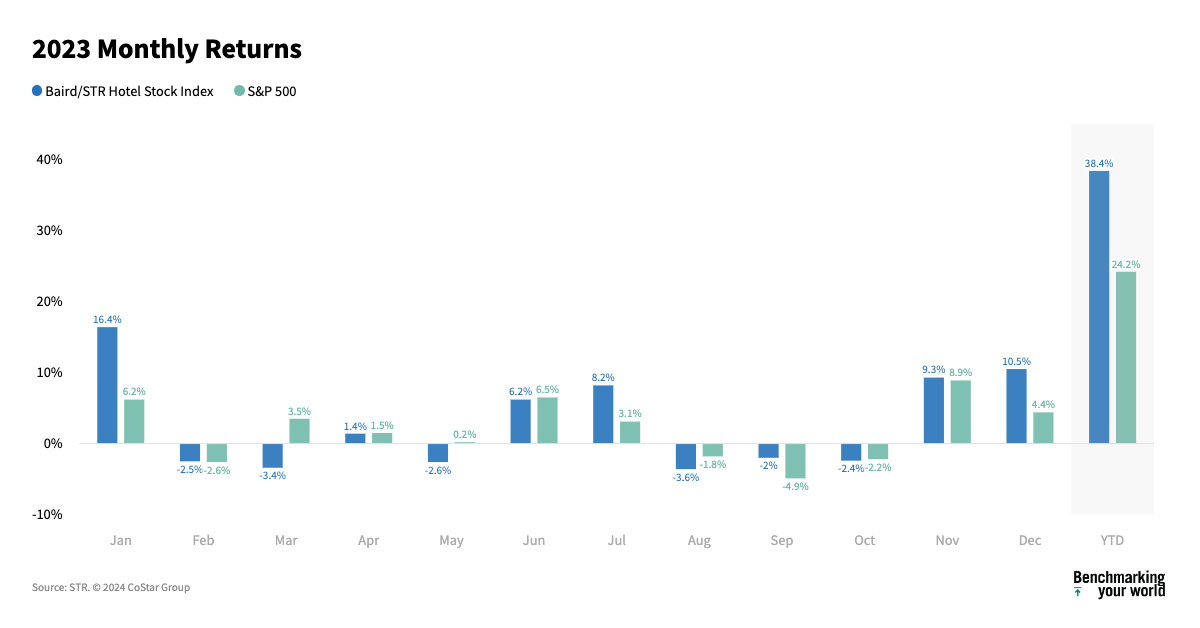

HENDERSONVILLE, Tennessee, and MILWAUKEE – The Baird/STR Resort Inventory Index jumped 10.5% in December to a degree of 6,760. For 2023, the inventory index was up 38.4%.

Resort shares – just like the broader market – completed 2023 on a excessive be aware because the ‘mushy touchdown’ narrative and decrease rate of interest outlook continued to spice up investor sentiment and valuation multiples. Each the lodge manufacturers and lodge REITs had been up greater than 10% in December and outperformed their respective benchmarks. For the 12 months, the lodge REITs’ 19% acquire greater than doubled the return of actual property shares broadly, whereas the lodge manufacturers’ 44% improve practically doubled the efficiency of the S&P 500. Michael Bellisario, senior lodge analysis analyst and director at Baird

The U.S. lodge trade completed the 12 months on strong footing. RevPAR rose 5% from the earlier 12 months, with development pushed by the primary quarter’s 10.4% improve attributable to a comparability towards Omicron-impacted months in 2022. Within the remaining quarters, RevPAR development averaged 3.1%, which is above the long-term quarterly common of two.9%. Occupancy continued to shut the hole to 2019 ranges, whereas absolute ADR and RevPAR remained properly above that benchmark on a nominal foundation and narrowed the hole on an inflation-adjusted foundation. Total, it was a strong and ‘regular’ 12 months for the trade. Amanda Hite, STR president

In December, the Baird/STR Resort Inventory Index surpassed the efficiency of each the S&P 500 (+4.4%) and the MSCI US REIT Index (+9.0%).

The Resort Model sub-index elevated 10.4% from November to 12,841, whereas the Resort REIT sub-index jumped 10.6% to 1,236.

Concerning the Baird/STR Resort Inventory Index and Sub-Indices

The Baird/STR Resort Inventory Index was set to equal 1,000 on 1 January 2000. Beforehand, the Index peaked at 3,178 on 5 July 2007, and the low occurred on 6 March 2009 at 573. The latest all-time excessive occurred on 22 November 2023 at 6,229.

The Resort Model sub-index was set to equal 1,000 on 1 January 2000. Beforehand, the sub-index peaked at 3,407 on 5 July 2007, and the low occurred on 6 March 2009 at 722. The latest all-time excessive occurred on 22 November 2023 at 11,932.

The Resort REIT sub-index was set to equal 1,000 on 1 January 2000. The sub-index’s all-time excessive was 2,555 on 2 February 2007, and the low occurred on 5 March 2009 at dropped to 298. The latest cycle highs had been 2,036 at 26 January 2015 and 1,440 on 17 March 2021.

The Baird/STR Resort Inventory Index and sub-indices can be found completely on Resort Information Now. The indices are cobranded and had been created by Robert W. Baird & Co. (Baird) and STR. The market-cap-weighted, price-only indices comprise 20 of the biggest market-capitalization lodge firms publicly traded on a U.S. change and try and characterize the efficiency of lodge shares. The Index and sub-indices are maintained by Baird and hosted on Resort Information Now, should not actively managed, and no direct funding could be made in them.

As of 31 December 2023, the businesses that comprised the Baird/STR Resort Inventory Index included: Apple Hospitality REIT, Ashford Hospitality Belief, Chatham Lodging Belief, Selection Inns Worldwide, DiamondRock Hospitality Firm, Hilton Worldwide Holdings, Host Inns & Resorts, Hyatt Inns, InterContinental Inns Group, Marriott Worldwide, Park Inns & Resorts, Inc., Pebblebrook Resort Belief, RLJ Lodging Belief, Ryman Hospitality Properties, Service Properties Belief, Summit Resort Properties, Sunstone Resort Traders, Wyndham Inns & Resorts, and Xenia Inns & Resorts.

This communication just isn’t a name to motion to interact in a securities transaction and has not been individually tailor-made to a selected shopper or focused group of purchasers. Analysis reviews on the businesses recognized on this communication are offered by Robert W. Baird & Co. Included, and can be found to purchasers by way of their Baird Monetary Advisor. This communication doesn’t present recipients with data or recommendation that’s enough on which to base an funding resolution. This communication doesn’t consider the precise funding goals, monetary scenario or want of any explicit shopper and might not be appropriate for all sorts of buyers. Recipients ought to think about the contents of this communication as a single consider investing resolution. Further elementary and different analyses can be required to make an funding resolution about any particular person safety recognized on this launch.

About Baird

Placing purchasers first since 1919, Baird is an employee-owned, worldwide wealth administration, asset administration, funding banking/capital markets, and personal fairness agency with places of work in the US, Europe and Asia. Baird has roughly 5,100 associates serving the wants of particular person, company, institutional and municipal purchasers and greater than $405 billion in shopper belongings as of June 30, 2023. Dedicated to being a terrific office, Baird ranked No. 23 on the 2023 Fortune 100 Finest Corporations to Work For® checklist – its twentieth consecutive 12 months on the checklist. Baird is the advertising identify of Baird Monetary Group. Baird’s principal working subsidiaries are Robert W. Baird & Co. Included and Baird Belief Firm in the US and Robert W. Baird Group Ltd. in Europe. Baird additionally has an working subsidiary in Asia supporting Baird’s funding banking and personal fairness operations. For extra data, please go to Baird’s web site at www.rwbaird.com.

About STR

STR offers premium information benchmarking, analytics and market insights for the worldwide hospitality trade. Based in 1985, STR maintains a presence in 15 international locations with a North American headquarters in Hendersonville, Tennessee, a world headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a number one supplier of on-line actual property marketplaces, data and analytics within the business and residential property markets. For extra data, please go to str.com and costargroup.com.

Haley Luther

Communications Supervisor

+1 (216) 278 0627

STR