The hospitality sector, specifically, is delicate to present challenges within the broader economic system: rising rates of interest, larger inflation and a decent labor market. Even so, the trade is making strides within the post-pandemic new regular as the main target shifts to high-end, experience-rich locations within the luxurious phase.

Within the early days of the pandemic, coastal and resort inns with lighter restrictions benefited from vacationers escaping quarantine. Economic system and extended-stay properties, which accommodated important staff in want of refuge, fared higher than amenity-rich properties harm by issues round social distancing. Three years later, upscale properties are actually main a rebound, having loved a renaissance constructed on regular room charges, distinctive lodging and an prosperous market that’s much less worth delicate in an inflationary economic system. The luxurious phase is predicted to stay sturdy amid the broader financial slowdown.

Luxurious charges and shopper expectations fly excessive

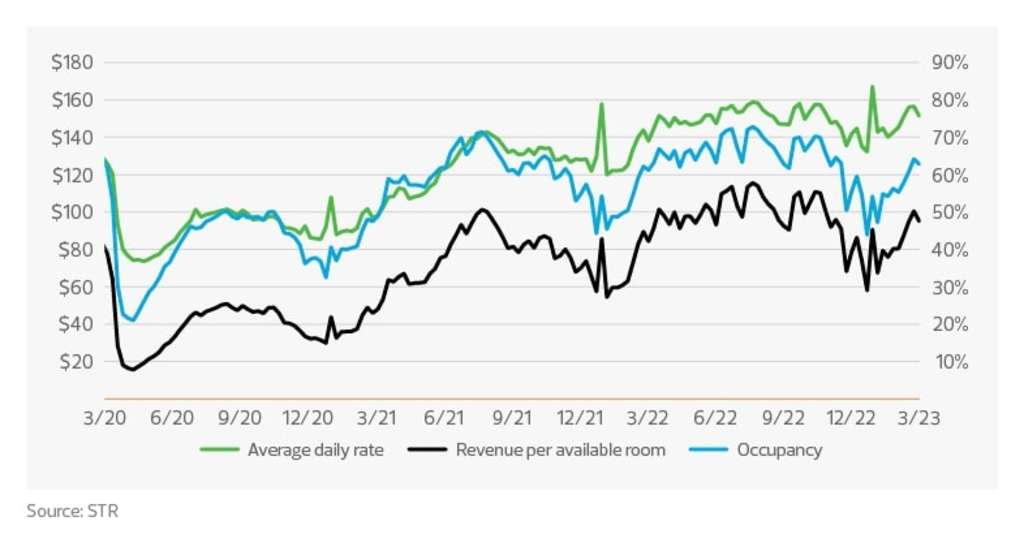

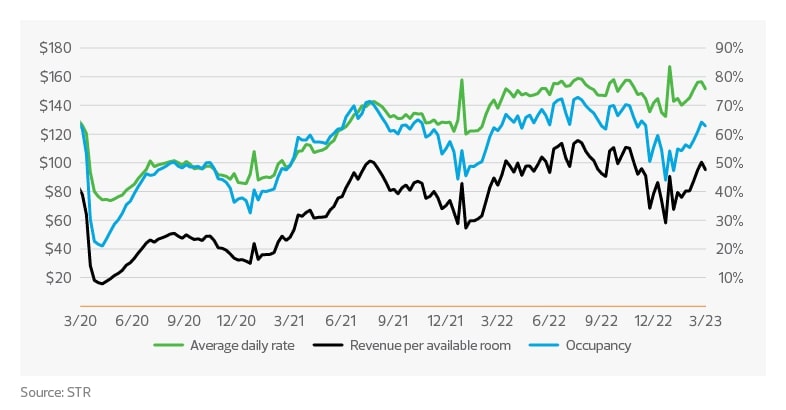

As shopper preferences have shifted from items to providers, extra vacationers search distinctive way of life experiences, and the hospitality sector seems to be assembly demand. In accordance with information analytics agency STR, U.S. inns reached 62.8% occupancy in early March, exceeding 2022 ranges and monitoring near 2019. Room costs are up, with the typical day by day price 14% larger than in 2019 at $151 and income per accessible room (RevPAR) 8% larger at $95.

Having realized from errors made in the course of the world monetary disaster of 2007-2009, homeowners and operators of upscale properties maintained their charges by means of the pandemic downturn to protect pricing energy. Consequently, when restrictions had been lifted, and journey started to normalize, friends had been used to paying day by day charges with no vital low cost. A diminished labor drive and restricted room provide allowed luxurious inns to maximise their margins and recuperate extra shortly. By August 2021, RevPAR was even with 2020 ranges and by December 2021, it had greater than doubled. We count on the development to proceed all through 2023 because the deal with wellness and therapeutic, recent eating choices, distinctive excursions and sustainability proceed to assist the luxurious house.

Labor gaps end in diminished hospitality expertise

As demand returns for all lodge segments, homeowners and operators are battling an ongoing labor disaster. Despite the fact that hospitality job experiences have persistently been favorable, the composition of staff out there leaves the trade trying to find expertise. In accordance with the U.S. Bureau of Labor Statistics, employment elevated by 311,000 jobs in February, together with 105,000 positions in leisure and hospitality, according to a median month-to-month jobs acquire of 91,000 since April 2020. Regardless of these features, job openings within the sector rose to 1.7 million accessible positions by means of February 2022, as filling accessible roles stays difficult, and a few staff beforehand dedicated to the sector have fled for alternatives in different industries. Labor market stress is mirrored in report pay charges of roughly $20 per hour and an lack of ability to match open jobs to staff with applicable abilities. As hiring prices rise for entry-level and middle-management positions, larger labor {dollars} scale back lodge revenue margins on the expense of a diminished hospitality expertise.

TAX TREND: Workforce – For hospitality corporations looking for and hold entry-level and middle-management workers, creating a compensation philosophy centered on whole rewards as a substitute of record-high hourly pay charges could successfully stability prices with choices that match staff’ preferences. Retirement packages, schooling alternatives or help and sponsored transportation advantages are only a few of many widespread choices with tax implications.

Regardless of challenges associated to the labor market, expertise and capital funding have bridged the gaps and allowed lodge operators to proceed offering high quality experiences. Though the general labor market stays robust, the hospitality trade faces an ongoing battle to search out expertise, which is able to form how vacationers work together with workers and onsite facilities.

Nominal charges and RevPAR exceed 2019 ranges

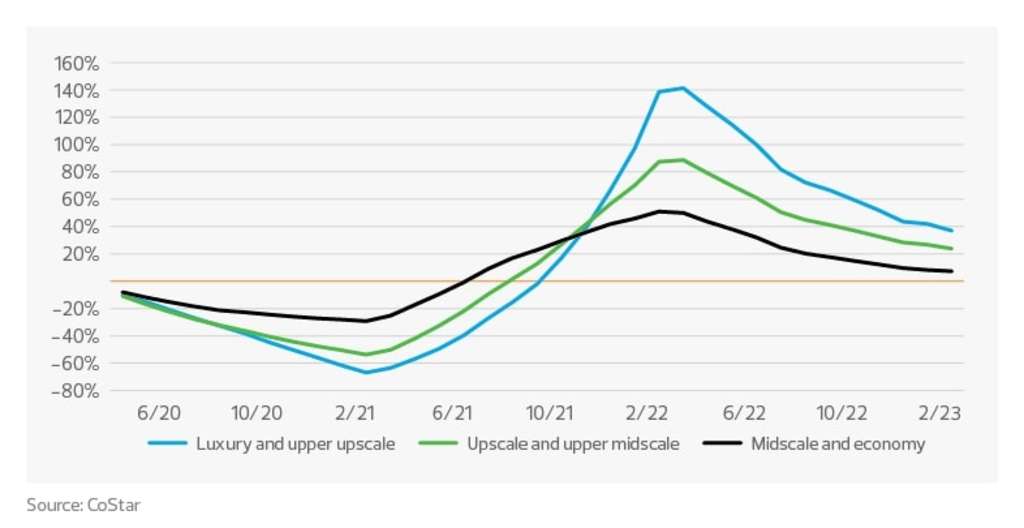

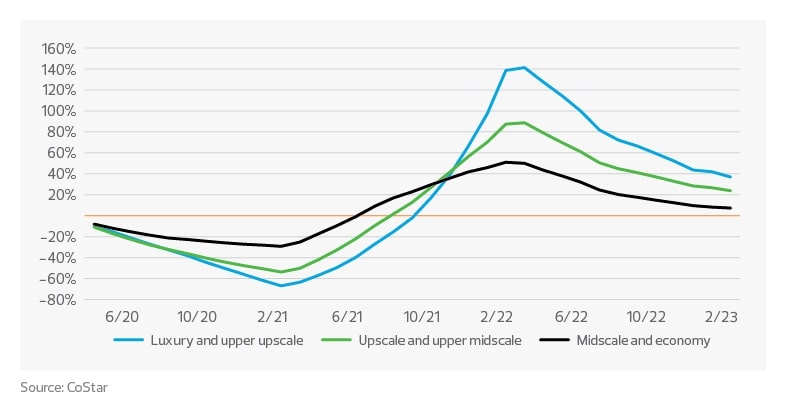

12-month % change–income per accessible room (RevPAR)

Capital markets harm by rates of interest and banking disruption

The outlook for capital markets exercise within the hospitality sector is cautious going into the second half of 2023. A collection of rate of interest hikes by the Federal Reserve has made the price of debt and fairness considerably dearer. Due to this fact, a slowdown in transactional exercise is predicted throughout the true property trade, together with hospitality. In the meantime, latest weak point within the U.S. banking sector, underscored by the demise of a number of regional banks, threatens monetary stability and liquidity prospects for lodge traders.

TAX TREND: Elevated rates of interest – Comparatively high-interest charges, mixed with an unfavorable change in tax regulation, have left many companies paying extra curiosity whereas seeing a lower of their tax deductions for curiosity expense. Consequently, actual property traders looking for to maximise their money after taxes could also be compelled to make an irrevocable election that excepts their enterprise from the restrict on the quantity of enterprise curiosity they will deduct from their taxable revenue.

Whereas luxurious lodge transactions dominated headlines in 2022, they accounted for simply 3% of the entire variety of transactions. In accordance with CoStar information, exercise was closely concentrated on the decrease and center segments of the market. Economic system inns represented 38% of trades, adopted by the midscale tier at 13%, with particular person traders driving the majority of transactional exercise. The outlook for 2023 requires robust investor curiosity within the luxurious phase and fewer prospects for enterprise and economic system inns as demand has waned nationwide. In the meantime, growing prices for debt, constructing supplies and development labor have muted new provide.

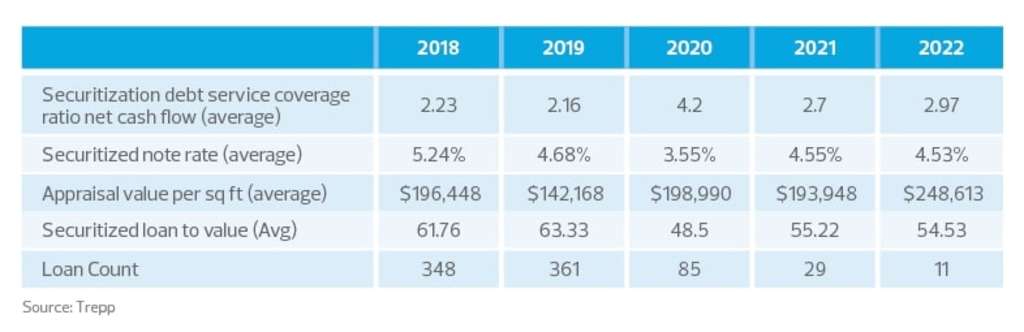

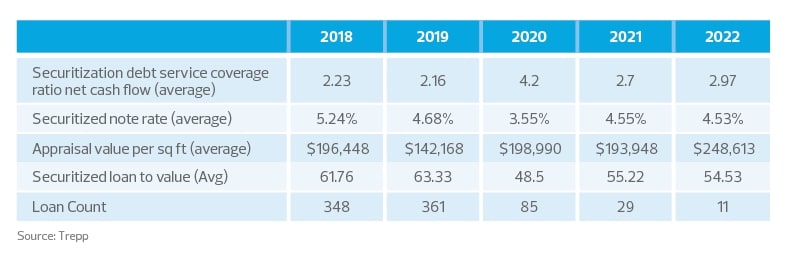

As lending necessities have tightened, private-label lodge industrial mortgage-backed safety (CMBS) issuances have dropped and securitized be aware charges have elevated. Whereas mezzanine and different debt financing stay accessible within the market, larger rates of interest, required capital enhancements deferment and depleted substitute reserves could show an excessive amount of for present homeowners to recapitalize their positions pushing transactions into the second half of 2023.

TAX TREND: Distressed belongings – Given the potential emergence of distressed belongings, understanding the tax implications of mortgage defaults can inform your choices and forestall surprises. Within the case of a mortgage default, a borrower may need to acknowledge revenue and pay tax regardless of not having the money.

Industrial mortgage-backed safety (CMBS) issuance tendencies

The takeaway

Whereas luxurious properties have loved a robust efficiency and investor favor, all hospitality segments stay challenged by inflation, a scarcity of expert labor and consequently diminished shopper experiences. Expertise options that offset labor shortages and people providing information mining and operational efficiencies can assist lodge operators and homeowners mitigate these difficult tendencies. The capital markets outlook for 2023 and 2024 will likely be various as robust belongings doubtlessly hit the market attributable to maturating debt. In the meantime, growing debt, supplies and labor prices will mute lodge provide progress.

This text is authored by Laura Dietzel and Ryan McAndrew, actual property senior analysts at RSM US LLP. The piece initially appeared right here.

About RSM US LLP

RSM is the main supplier {of professional} providers to the center market. The purchasers we serve are the engine of worldwide commerce and financial progress, and we’re targeted on creating main professionals and providers to fulfill their evolving wants in at this time’s ever-changing enterprise panorama. Our goal is to instill confidence in a world of change, empowering our purchasers and folks to understand their full potential.

RSM US LLP is the U.S. member of RSM Worldwide, a world community of impartial assurance, tax and consulting companies with 57,000 individuals in 120 international locations. For extra info, go to rsmus.com, like us on Fb, observe us on Twitter and/or join with us on LinkedIn.