Debate continues on the extent to which international tourism restoration will probably be impinged by rising inflationary pressures and potential journey disruption.

To date, any potential affect has not been seen within the hospitality sector. The STR Market Restoration Monitor, primarily based on information for the week ending 30 July 2022, confirmed that greater than 90% of North American markets and round 80% of world markets have been reaching income per out there room (RevPAR) that was 80% or above 2019 ranges when adjusted for inflation.

Nevertheless, the anticipated seasonal slowing of peak leisure demand season is starting and intersecting with vital macroeconomic headwinds. With that in thoughts, STR examined the attitudes of customers within the present context of contrasting tourism fortunes. Finally, we wish to proceed monitoring how journey sentiment is being impacted by rising monetary and journey pressures alongside easing COVID-19 issues.

Our newest survey from July 2022 highlights that customers are vigilant about their private funds and COVID-19, however wanderlust continues to stoke journey demand even with extra concern round journey disruption.

Stalling short-term sentiment, optimistic long-term outlook

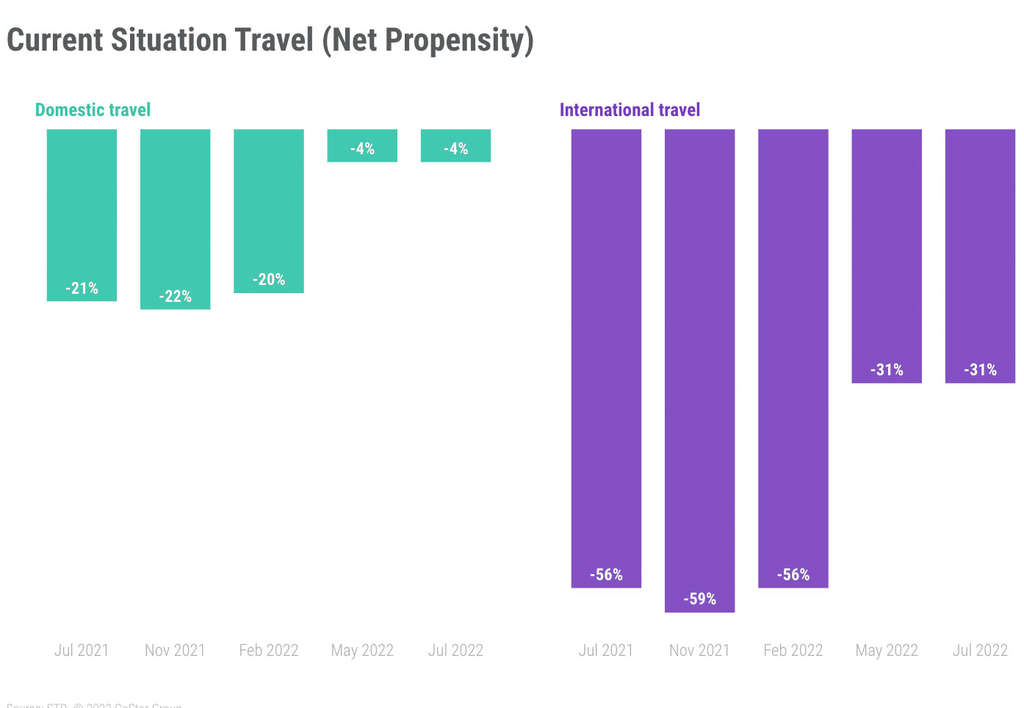

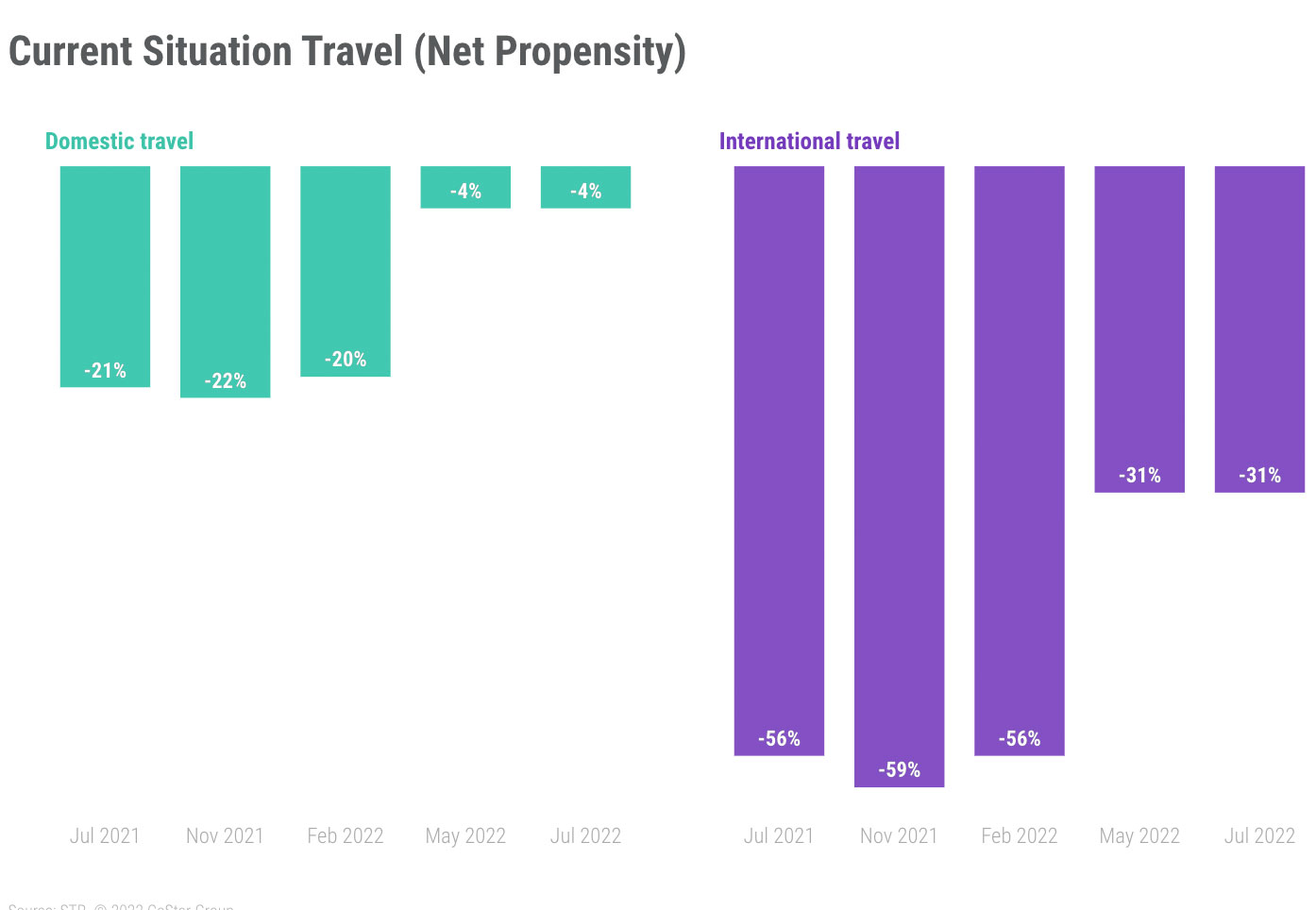

Throughout earlier analysis in Could 2022, STR confirmed an uptick in sentiment as web propensity to journey – the distinction between those that said they have been roughly more likely to journey within the present atmosphere – elevated considerably for each home and worldwide journeys in contrast with February 2022.

Nevertheless, the most recent findings revealed an identical sentiment with Could 2022 as web propensity to journey within the present state of affairs was unchanged, remaining in unfavorable territory for each home and worldwide journeys (-4% and -31%, respectively). Whereas the outlook improved in contrast with final yr, these outcomes recommend that monetary pressures, COVID-19 and different elements proceed to overwhelm the general attraction of journey at the moment.

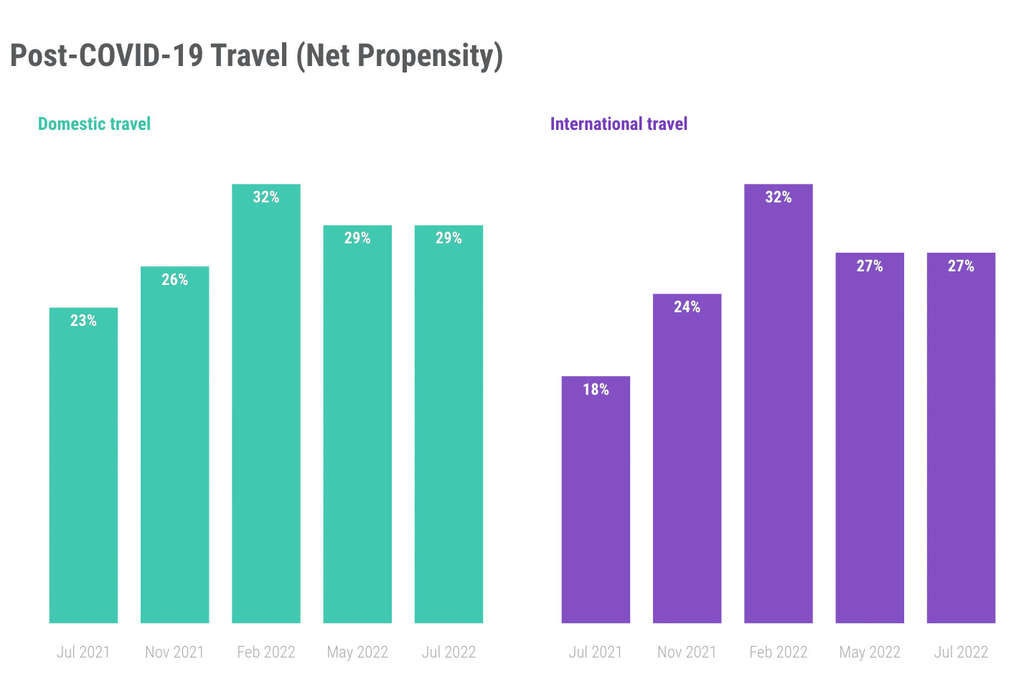

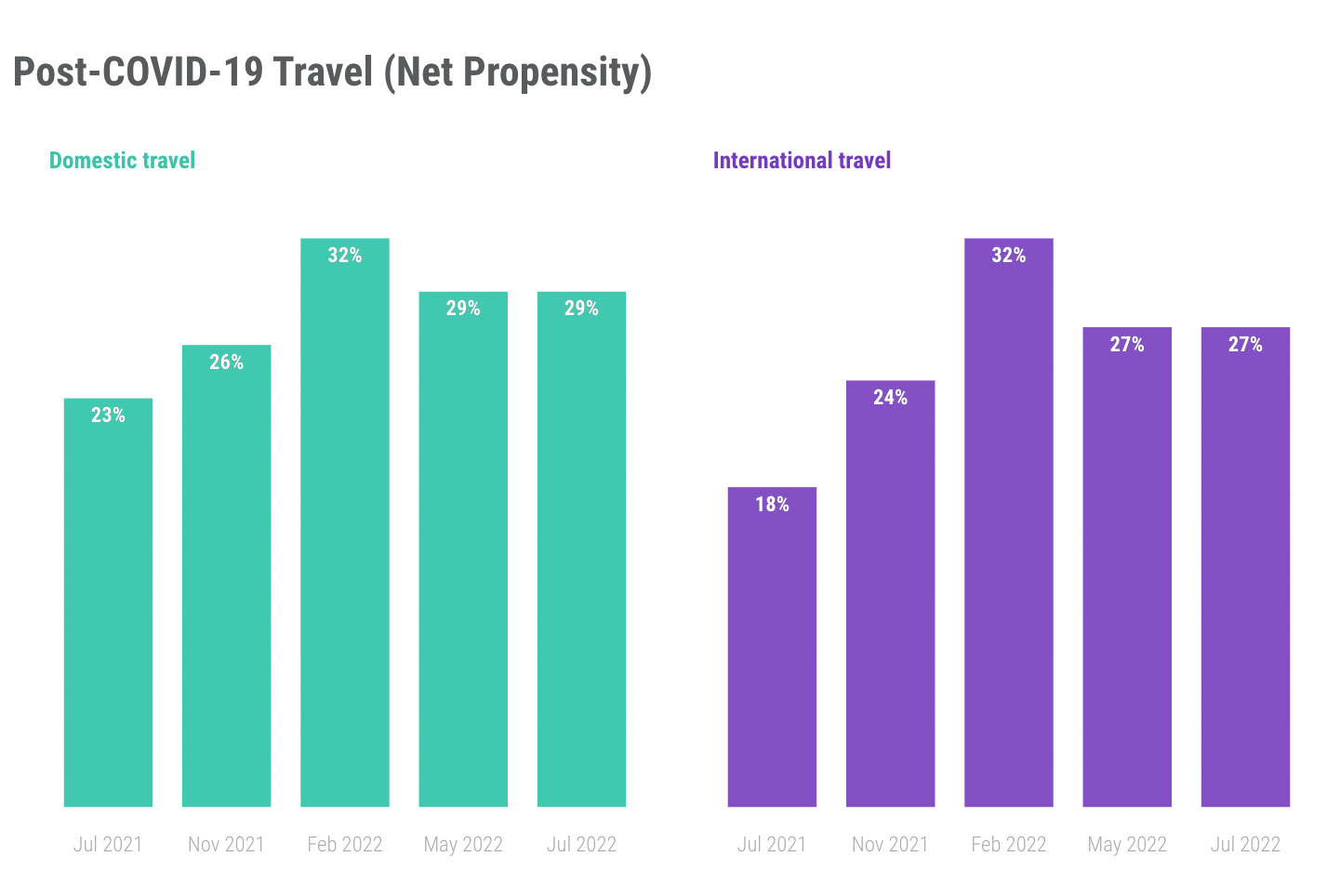

Regardless of stalling short-term sentiment, attitudes towards tourism within the medium- to long-term remained extraordinarily optimistic. Web propensity to journey was once more near +30% for each home and worldwide journeys. These outcomes sign wholesome intent amongst customers to extend their journey cadence sooner or later and the continued presence of sturdy underlying demand.

New barrier on the block: Journey cancellations

Journey cancellations and disruptions have been a lot publicized lately as airways and airports, particularly, have needed to handle surging demand alongside supply-chain and staffing points. Journey disruption issues consequently emerged as a major barrier to journey with many seemingly influenced by media studies in addition to first-hand and anecdotal unfavorable experiences.

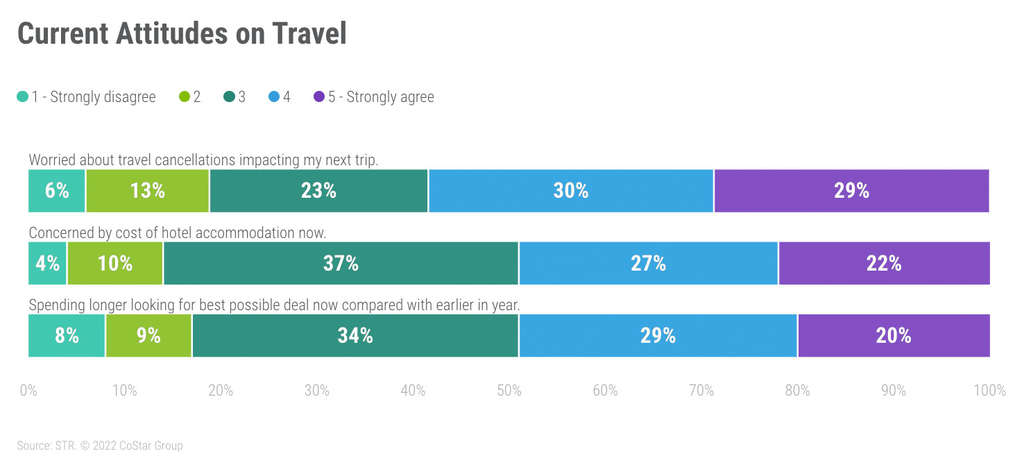

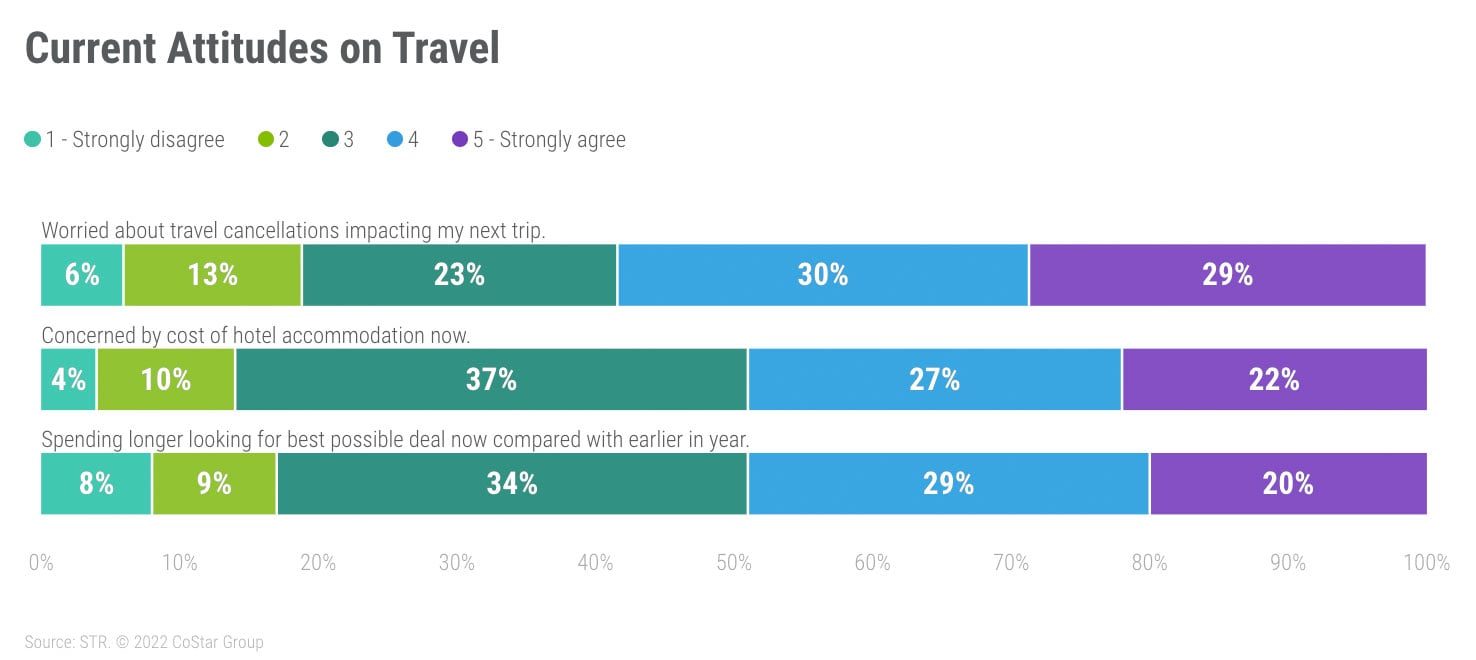

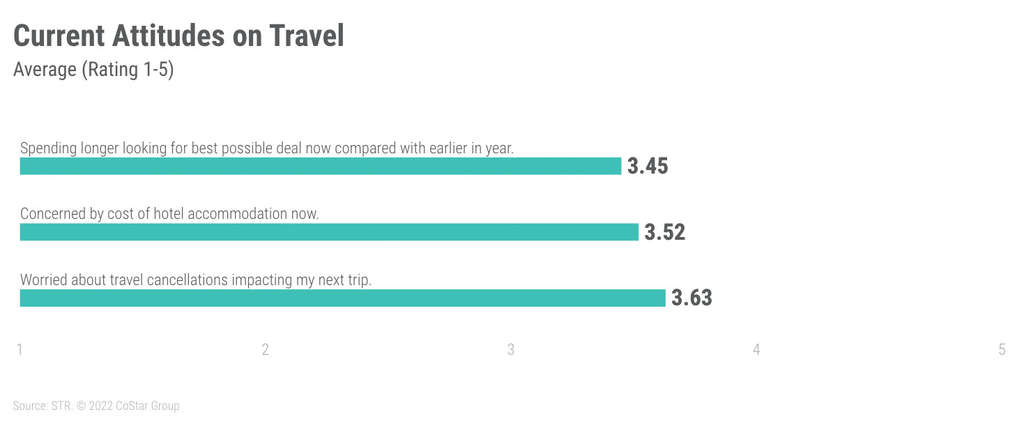

Total, almost six in 10 mentioned they’re anxious about cancellations and disruptions impacting their subsequent journey. North People expressed extra concern than others as 63% have been anxious about journey disruption in contrast with 54% amongst Brits and Europeans.

In the meantime, round half agreed they’re involved by the price of resort lodging now and an identical proportion mentioned they’re spending extra time searching for offers. These findings recommend customers are more and more scrutinizing the price of journey but stay desirous to get away. How customers commerce off rising prices with the advantages of journey is a key concern which may form international tourism efficiency within the coming months.

Monetary elements are higher threats, concern across the struggle in Ukraine decreased

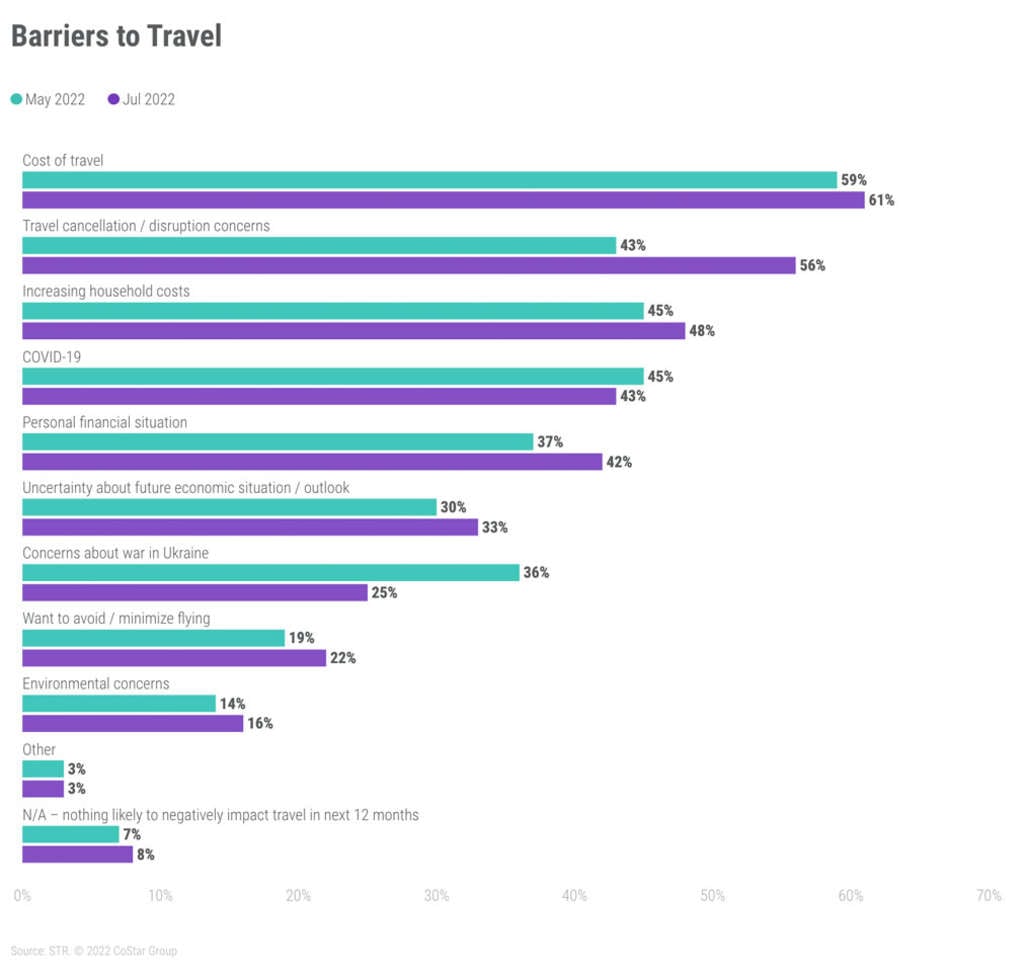

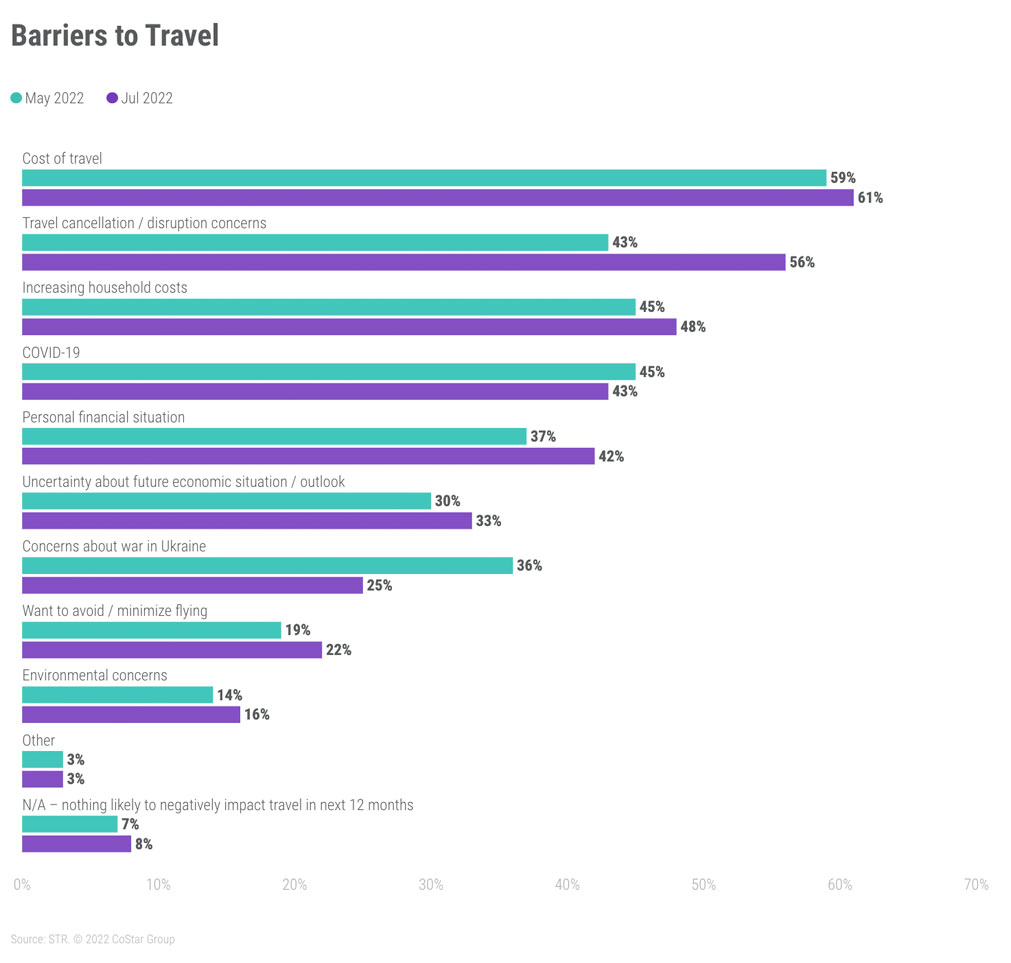

The price of journey stays the most important impediment to tourism progress. According to Could 2022, round 60% thought prices would negatively affect journey within the subsequent 12 months. Unsurprisingly for the explanations mentioned above, the second best barrier was journey cancellations and disruptions talked about by 56% in contrast with 43% in Could 2022.

There was a sample additional down the pecking order in total significance as different monetary limitations – rising family prices, private monetary conditions and financial uncertainty – elevated in contrast with Could 2022. These findings spotlight that financial issues have strengthened in latest months. How the world economic system unfolds will decide if these limitations pose a extra vital risk for tourism later within the yr.

In the meantime, conversely, the struggle in Ukraine was perceived to be a lesser journey barrier than in Could 2022. 1 / 4 thought it will negatively affect their travels within the subsequent 12 months, which was properly under Could 2022 (36%). Europeans although have been extra guarded than others in regards to the struggle with 31% seeing it as a barrier.

Price-benefit evaluation reckoning lies forward

The outlook for journey stays upbeat resulting from sturdy underlying demand regardless of rising financial uncertainty and inflationary pressures. Journey disruption issues have been presumably an even bigger issue than monetary points, which led to the muted sentiment on this newest survey. The excellent news is that journey disruptions, not like monetary points, are one thing the business can handle as soon as staffing and supply-chain points have eased. The seasonal dip in future demand can even enable companies to raised handle the state of affairs.

Nevertheless, these elements mixed with lingering COVID-19 issues create a difficult backdrop for tourism. Tourism companies, like customers, will probably be eagerly monitoring authorities efforts to mitigate the financial challenges forward. How customers with reducing actual incomes consider the general value and advantage of journey can even affect efficiency going ahead. Journey disruption – each perceptions and actuality – is more likely to stay a topical concern throughout the remaining interval of peak season journey.

About STR

STR offers premium information benchmarking, analytics and market insights for the worldwide hospitality business. Based in 1985, STR maintains a presence in 15 international locations with a company North American headquarters in Hendersonville, Tennessee, a world headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the main supplier of business actual property info, analytics and on-line marketplaces. For extra info, please go to str.com and costargroup.com.