Touring within the period of the COVID-19 pandemic has change into a bit extra unsure because you have no idea what further bills may include COVID remedy or hospitalization.

Having COVID journey insurance coverage is a necessity and in some international locations one of many entry necessities!

Since we’re dedicated to supporting the well being and well-being of our fellow vacationers throughout this unprecedented disaster, now we have chosen 8 insurance coverage journey plans that cowl COVID-19 we contemplate one of the best match for British, American, EU residents, and overseas nationals from different international locations.

So maintain studying to study one of the best plans when touring, working, dwelling, or learning overseas.

Disclaimer: Most journey insurance coverage corporations are updating and adapting to the “new regular” option to journey all over the world. We strongly advise you to test together with your insurance coverage firm earlier than committing to any insurance coverage plan.

Covid TRAVEL INSURANCE Plans to Use throughout Pandemic

Greatest for nomads, (lengthy/short-term) vacationers, and distant employees no matter their nationality.

Journey medical insurance coverage for nomads but in addition brief or long-term vacationers.

Execs:

- Nice match for digital nomads, vacationers, and distant employees no matter their nationality. Ideally suited for lengthy but in addition short-term journeys!

- COVID-19 Protection: As of August 1st, 2020, this insurance coverage covers COVID-19 illness and works the identical as every other sickness and doesn’t fall underneath every other coverage exclusion or limitation.

- Included in your earlier Safetywing plan?: If you’re a brand new Safetywing new purchaser, the COVID-19 protection might be routinely a part of your insurance coverage plan. If not, we advocate you to improve your plan right here. You’ll be able to join this insurance coverage after your journey has already began.

- Value vs Age: Fairly reasonably priced contemplating the pandemic – These costs cowl 4 weeks or 28 days with as much as a most of 364 days after which you have to to repurchase.

- 10 to 39 years outdated US $40.04 (If you’re not touring in or to america)

- 10 to 39 years outdated US $73.08 (If you’re touring in or to america)

- 40 to 49 years outdated US $64.68 (If you’re not touring in or to america)

- 40 to 49 years outdated US $120.40 (If you’re touring in or to america)

- See costs for different age teams right here.

- What about outside actions – Am I coated?: Safetywings covers greater than 94 leisure actions together with browsing, biking, climbing, and snowboarding.

- Do I’ve to pay insurance coverage for my younger youngsters? 1 younger baby (aged 14 days to 10 years outdated) per grownup, as much as 2 per household are coated without cost.

Cons:

- Safetywing solely covers your medical bills for those who contract COVID-19 after your protection beginning date.

- It doesn’t cowl the COVID-19 exams most international locations are requiring you to submit upon touchdown of their territories.

- This insurance coverage doesn’t cowl residents from Iran, Syria, North Korea or Cuba (or have Cuba as your citizenship).

Click on right here to study extra about this plan.

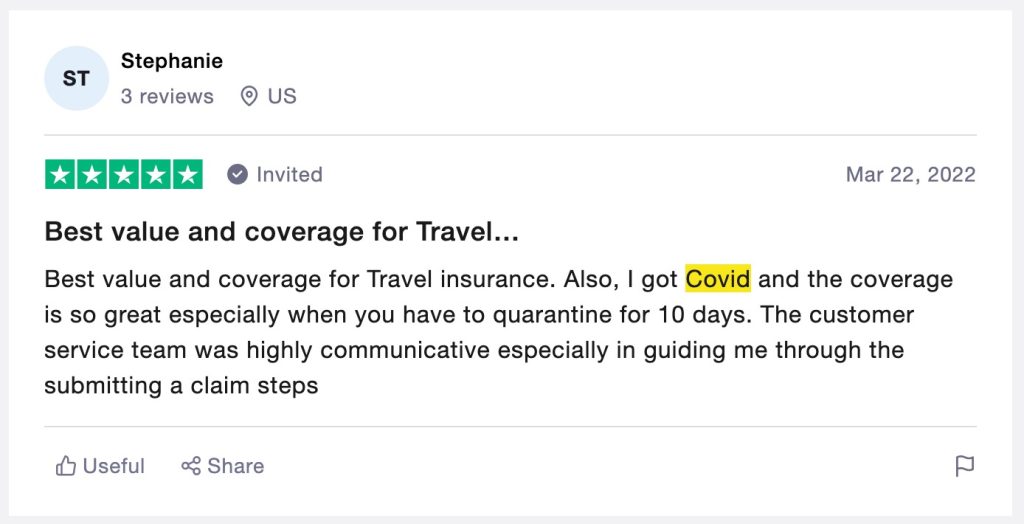

Security Wing Covid Journey Insurance coverage Opinions on Trustpilot:

For long-term digital nomads, we additionally advocate checking their Distant Medical insurance which is extra expensive however covers pre-existing circumstances or covers you additionally in your house nation.

You may additionally have an interest to test 8 digital nomad insurance coverage plans comparability for 2022.

Heymondo Journey Insurance coverage

Greatest for vacationers occurring single journeys who don’t need to decide to a long-term contract.

Most journey insurance coverage corporations provide safety for 30 days to six months. Heymondo not solely affords safety for lengthy keep plans, but in addition for single journeys if you end up touring for work or tourism and know your departure and return dates.

Execs:

- Nice match for – Single or multiple-single-trip vacationers

- COVID-19 Protection: In case you check constructive for COVID-19 whereas touring, Heymondo will cowl medical help from USD $100.000 as much as USD $10.000.000 (circumstances apply).

- Protection restrict – USD $ 250,000 or USD $ 500,000 relying in your plan

- Time of buy: You will get it earlier than or throughout your journey

- You don’t have to decide to a long-term contract

Particular COVID-19 protection options:

- PCR testing in case you present COVID-19 signs

- A reimbursement on your pre-paid, non-refundable bills for those who or an in depth member of the family will get sick with COVID-19.

- Medical transport and repatriation dwelling in case you miss a returning flight as a consequence of a COVID-19 an infection.

Different advantages:

Heymondo Journey Insurance coverage Opinions from Trustpilot

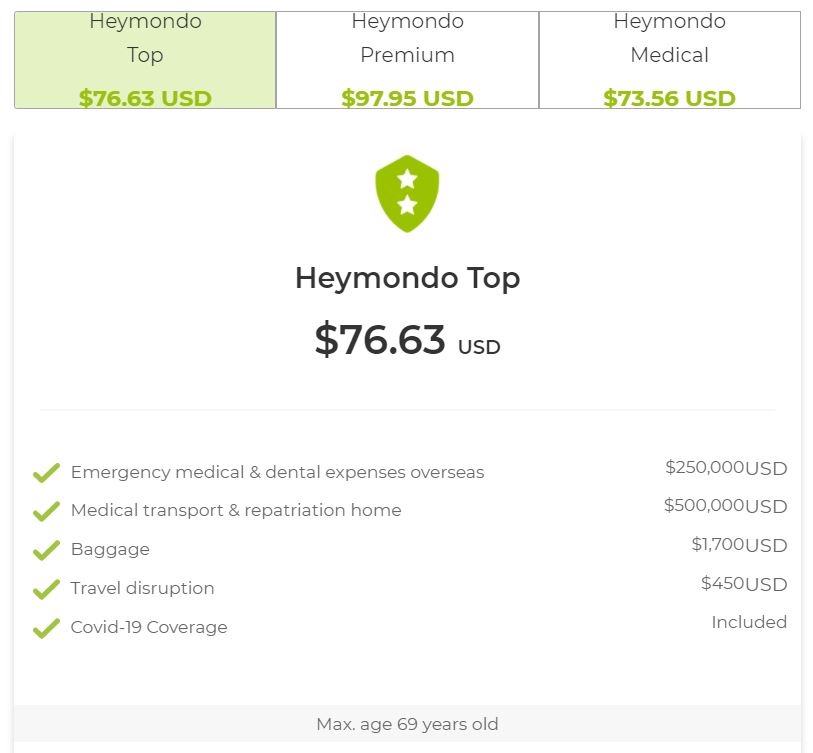

Each Heymondo High and Heymondo Premium cowl:

- Medical and dental emergencies abroad

- Medical transport and repatriation

- Baggage

- Journey disruption

- COVID-19 associated remedies

Cons:

- It could be somewhat bit costly. For a 2-week journey from the U.S. to Europe Heymondo Premium prices USD $ 97.95, Heymondo High prices USD $ 76.63 and Heymondo medical prices USD $ 73,56.

- Heymondo medical doesn’t cowl baggage loss or journey disruption.

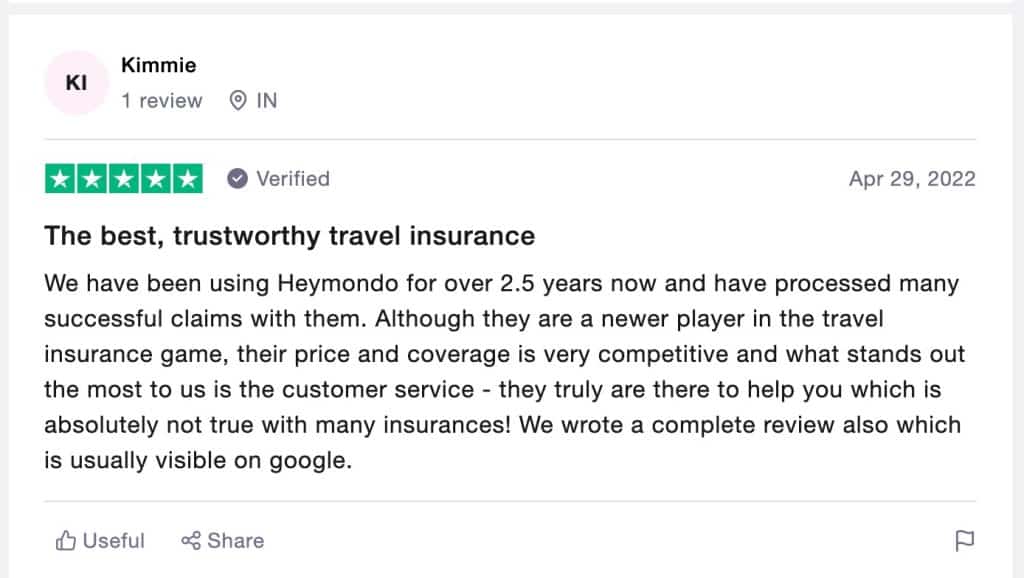

CoverAmerica-Gold, COVID Journey Insurance coverage for US by VisitorCoverage

Greatest for nomads, vacationers, and distant employees visiting the US

CoverAmerica-Gold is an effective selection for vacationers visiting the U.S. who’re NOT residents or residents of that nation. VisitorsCoverage affords loads of insurance policy for wants of any sort of journey.

Execs

- Nice match for nomads, vacationers, and distant employees visiting america

- COVID-19 Protection: This plan covers COVID-19 as whether it is every other medical situation. Nevertheless it must be bought for no less than 30 days to be eligible for this profit.

- Protection restrict? It could cowl as much as US1,000,000 (circumstances apply).

Particular COVID-19 protection options

- COVID-19 Protection and Day by day Quarantine Profit for journeys over 30 days

- Pressing Care go to with solely $15 copay

- Border Entry Safety

Different advantages

- Covers acute onset of pre-existing circumstances

- Lack of passport or journey paperwork

- Overseas excursions and cruise protection round North America

- Emergency dental remedy & eye examination

- Missed connection profit obtainable throughout worldwide journey to the U.S.

Supply: Cowl America Gold Brochure

Cons:

- It’s NOT obtainable for People, US Inexperienced Card Holders or long run visa holders, who keep within the USA completely, and pay taxes within the USA.

- It does NOT cowl residents from Iran, Syria, US Virgin Islands, Ghana, Nigeria, and Sierra Leone.

Click on right here to study extra about this plan.

Very comparable package deal to the one talked about above for touring to america.

This plan is right for US residents touring to Canada but in addition guests from different international locations all over the world.

Verify extra data about this plan right here.

Travelex insurance coverage has constructed its journey portfolio contemplating not solely common vacationers but in addition digital nomads and the brand new distant employees.

It has demonstrated glorious protection on single journeys, brief luxurious getaway weekends in addition to lengthy stays in overseas international locations.

One of many options we like essentially the most about Travelex Insurance coverage Providers is that this firm permits folks to customise their protection in response to the particulars of their journey wants. One other good attribute is that even the fundamental plan will get you ALL the necessities. We discover it an amazing match for avid vacationers as a result of it brings flight-specific safety.

We’ve got gathered some execs and cons so you may make an knowledgeable choice!

Execs:

- 24/7 Help with a journey concierge! – What number of instances have you ever missed nice spots or haven’t accessed to advantages simply since you didn’t know they existed? Nicely, Travelex journey help will serve you as journey concierge even in authorized issues. No one is aware of when you’ll be able to mess up with unknown guidelines out of the country.

- Covers COVID-19: This can be a should have. For those who check constructive for COVID-19 it’s possible you’ll be eligible for journey cancelation, medical remedies and even evacuation.

- Just like the earlier one. In case of a medical emergency, Travelex will cowl your emergency remedy and evacuation. It additionally features a companion.

- In case you, or your companion passes away, this coverage additionally covers the price of transporting stays dwelling.

- 98% of insurance coverage claims are paid.

- In case you need to cancel or interrupt your journey for any of the coated causes, you’re going to get a reimbursement of the cash you’ve already spent in your journey.

Cons:

- It’s particularly essential for folks at elevated danger of extreme sickness from COVID-19, the protection supplied for COVID-19 could also be sort of restricted. Think about an improve.

- Beware that some primary companies could have a further price.

- It’s not the most affordable one. A 22-year-old distant employee pays from $ 324 and $491 for a 90-day journey.

In the beginning, World Nomads journey insurance coverage has been endorsed by Nationwide Geographic, Eurail, Worldwide Volunteer HQ, and Lonely Planet. This will likely provide the first sneak peek of the standard of the service you’re shopping for.

World Nomads insurance coverage covers nomads, distant employees and journey seekers from 150 international locations. You should buy brief or long-term in response to your journey wants.

Let’s discuss in regards to the fundamentals in the course of a pandemic; this insurance coverage affords medical evacuation and 24-hour emergency help. This can be associated to journey actions you’re partaking in, or in case you get sick with COVID-19 in a rustic that won’t have the medical services you’re used to.

Execs:

- Phrase Nomads affords particular companies for U.S. vacationers. In case you get COVID-19 whereas touring, you’ll get your medical emergency, medical evacuation and journey delay or interruption coated.

- If you wish to have interaction in excessive sports activities or very journey actions, their Explorer program will cowl you at each step.

- Extending your protection service is at your fingertips. As soon as your protection is over you’ll be able to go surfing and simply lengthen it.

- Claims are dealt with in a short time.

- Its Explorer Coverage is exclusive out there.

Cons:

- It may be a bit costly. However in case you are a sort of journey traveler, that is the fitting match for you.

- World Nomads cowl folks in additional than 150 international locations; this additionally implies that prices and coverages can range relying on the realm you’re touring to.

- It’s fairly doable it is advisable have medical insurance in your nation of origin in an effort to get their add-on companies.

- Scooter associated accidents are principally not coated.

Abstract

World Nomads insurance coverage offers you most likely one of the best protection for those who like to have interaction in journey actions at a good worth. The World Nomads normal plan, just about covers what others do. However in case you need an improve, this could be an amazing selection.

For additional details about COVID-19 protection, click on right here.

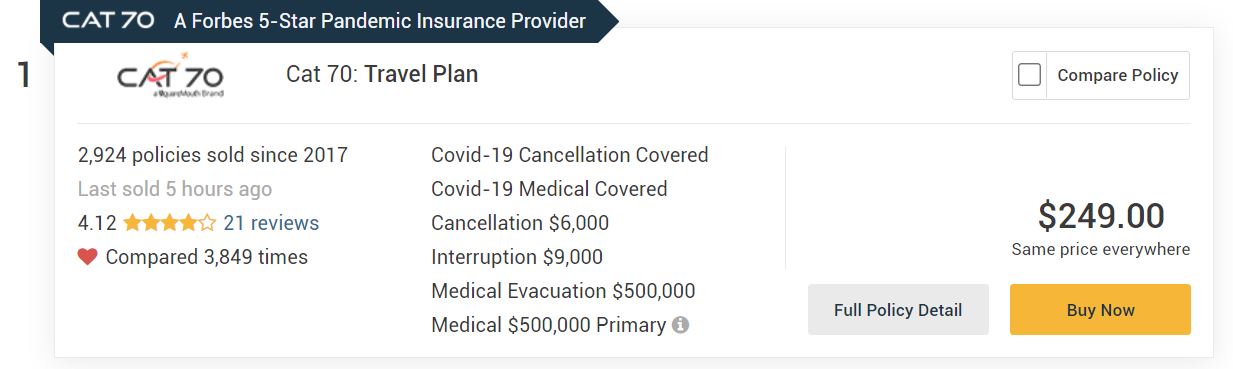

CAT 70 – Forbes 5-Star Pandemic Insurance coverage Supplier

Greatest for American, British and UEA residents touring and dealing abroad.

CAT 70 is a Forbes 5-Star Pandemic Insurance coverage Supplier for “one of the best protection ranges” throughout all of Forbes’ metrics. It has additionally been acknowledged nationally and internationally with 16 awards in 6 years.

Execs

- Nice match for American, British and UEA residents touring and dealing abroad.

- COVID-19 Protection – That is fascinating – CAT 70 affords a time-sensitive profit referred to as “Cancel for Any purpose” that may reimburse as much as 75% of your journey price if you need to cancel it at the very least 2 days previous to departure.

- Costs are primarily based in your journey price – For a 1-month journey to Spain from the U.S. costing USD $6,000 whole, CAT 70 affords USD $6,000 for cancelation, USD $9,000 for interruption and USD $500,000 for medical evacuation.

Particular COVID-19 protection

To be eligible for the “Cancel for Any Purpose” program vacationers should make the acquisition inside 14-21 days of the primary journey reserving.

- As much as 75% reimbursement in case of border closures, journey bans or comparable

- As much as 100% reimbursement in case you contract COVID-19 earlier than your departure date

- For those who contract Covid-19 throughout your journey, this profit can reimburse your unused journey bills, in addition to further transportation bills you incur to return dwelling.

Most journey plans embody advantages past journey cancellation and medical protection. Nonetheless, CAT 70 is among the few insurance policy that provide further advantages that resonate with pos-pandemic journey. The CAT 70 plan scores among the many highest in our rankings as a result of it additionally offers reimbursement for:

- Journey cancellation as a consequence of accidents, climate, hurricanes and terrorism

- Journey delay

- Missed connections

- Baggage and private gadgets

Cons

- This journey insurance coverage is obtainable for U.S., United Emirate Arabs, and United Kingdom residents solely.

Liaison Journey Plus*

Greatest for vacationers, and distant employees visiting the U.S

Journey insurance coverage for guests to the U.S. and U.S. residents touring overseas.

Execs

- Nice match for nomads, vacationers, and distant employees all over the world.

- COVID-19 Protection – This plan is designed to guard you when you navigate this “new regular” atmosphere, even within the excessive case you get COVID-19 when touring outdoors your own home nation.

Particular COVID-19 protection options

- Medical remedy for COVID-19 (the illness)

- SARS-Cov-2 (the virus), and any mutation or variation of SARS-CoV-2

- Journey help companies (Together with emergency medical evacuation)

- Repatriation

- Emergency medical reunion

- Return of youngsters

- Return of mortal stays

- Native burial or cremation can apply

- Protection restrict? As much as 5,000,000

- Protection Space – you’ll be able to select between two choices:

- Worldwide protection together with the USA

- Worldwide protection excluding the USA

- Any pre-existing circumstances? – It covers them via the profit for acute onset of pre-existing circumstances.

- Value – It relies on a number of components. You should buy from 5 to 364 days. Click on right here for costs.

Different traveler advantages

- Lack of checked baggage – US $50 per article, US $500 per incidence

- Journey interruption US $5,000

- Journey delay US $100 per day, 2-day restrict per incidence

- Misplaced or stolen journey paperwork US $100

- Border entry safety (for non-United State residents touring to america) US $500

- Private legal responsibility US $50,000

Cons

- Vacationers have to be at the very least 14 days outdated and underneath 75 years to be coated by this plan

- It doesn’t cowl residents from Iran, Nigeria, Cuba, Iran, Syria, Virgin Islands, Gambia, Ghana, Sierra Leone, and North Korea.

- It doesn’t cowl journeys to Antarctica, Iran, Syria, Cuba, and North Korea.

Click on right here to study extra about this plan.

*(Administered by Seven Corners, Lloyd’s of London and Tramont Insurance coverage Firm)

AXA – International Healthcare / Covid Journey Insurance coverage

Greatest for British residents touring and dealing abroad, ex-pats, and different EU residents

This firm offers medical care, routine checkups and prolonged hospital stays for vacationers all over the world.

Execs

- Nice match for British residents touring and dealing abroad, ex-pats and different U.E. residents.

- COVID-19 Protection applies solely to members on an AXA worldwide insurance coverage plan

Particular COVID-19 protection options

- Your healthcare advantages will apply as regular for those who’re recognized with the coronavirus.

- Out-patient care (if included it in your coverage)

- Therapy within the UK (circumstances apply)

- Evacuation and repatriation profit (circumstances apply)

- Coronavirus screening at airports (you’re coated in case your plan consists of protection for routine well being checks)

Different advantages

- This insurance coverage firm permits selecting between long-term and short-term stays.

- Value – Is dependent upon the international locations you’re visiting or dwelling in.

Cons:

Click on right here for more information about insurance policy with this firm

AXA Schengen Insurance coverage

Greatest for vacationers visiting the European Union or seeking to acquire a Schengen visa.

Execs

- Nice match for vacationers visiting the European Union and its Schengen related international locations or seeking to acquire a Schengen visa.

- Funds-friendly – (from €20 for a keep of 1 week)

- AXA doesn’t care about your age or nationality. At AXA everyone seems to be equal!

Plans

Low Value

- Solely €0.99 per day

- Covers medical bills of as much as €30,000

- It has repatriation companies

- COVID protection underneath circumstances*

- Meets necessities from the E.U

Europe Journey

Entitles an prolonged safety for you and your loved ones

- Solely €1.50 per day

- Covers medical bills of as much as €100,000

- Prolonged safety in all Schengen international locations and Eire

- Provides repatriation companies

- COVID protection underneath circumstances*

Multi Journey Plan

- Solely €298 per yr

- Covers medical bills of as much as €100,000

- Prolonged safety in all Schengen international locations and Eire

- Provides repatriation companies

- COVID protection underneath circumstances

Cons

The superb print on the COVID-19 protection. The corporate particularly says “our insurance coverage insurance policies cowl you whenever you journey in accordance with official suggestions issued by your own home state’s overseas ministry or the federal government within the nation of your vacation spot.”

In an ever-changing Covid-19 it may be a bit troublesome to meet up with all well being laws.

For example, their insurance policies is not going to cowl you for those who journey towards the Overseas, Commonwealth and Improvement Workplace (FCDO) recommendation.

International locations coated by every plan:

AXA Schengen Low Value insurance coverage offers protection for all Schengen Space member states: Germany, Austria, Belgium, Denmark, Spain, Estonia, Finland, France, Greece, Hungary, Italy, Iceland, Liechtenstein, Latvia, Lithuania, Luxembourg, Malta, Norway, Netherlands, Poland, Portugal, Czech Republic, Slovakia, Slovenia, Sweden, and Switzerland.

AXA Europe Journey and AXA Multi Journey covers all European Union member states : Germany, Austria, Belgium, Bulgaria, Cyprus, Croatia, Denmark, Spain, Estonia, Finland, France, Greece, Hungary, Italy, Eire, Iceland, Liechtenstein, Latvia, Lithuania, Luxembourg, Malta, Norway, Netherlands, Poland, Portugal, Czech Republic, Romania, Slovakia, Slovenia, Sweden, and Switzerland.

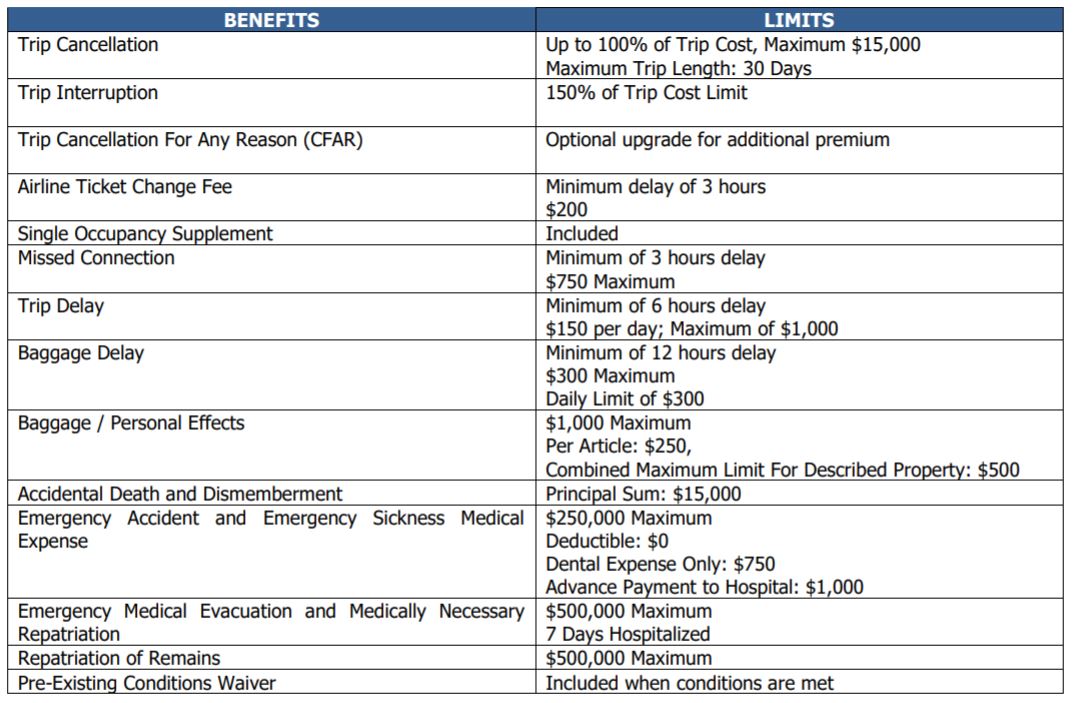

USI Affinity Journey Insurance coverage Providers – Ruby Coverage

The USI Explorer Ruby plan affords excessive limits of main medical expense and emergency medical evacuation protection.

It additionally affords good “Journey Cancellation” protection with non-obligatory “Cancel For Any Purpose” (CFAR), which covers missed connections, aircraft ticket change charges, journey delay, and extra.

Execs:

- The COVID medical protection supplied by the plan is main, so you don’t want to make use of your personal medical insurance plan first.

- Within the occasion of unexpected conditions reminiscent of sickness, harm, or dying, it covers as much as 100% of your journey.

- Journey interruption can be included. It pays for “unused, non-refundable journey preparations pay as you go to the journey provider(s); or further transportation costs; or returning air journey as much as the price of an financial system journey, whichever is decrease.”

- Vacationers might be reimbursed once they should cancel their holidays as a consequence of diseases, harm, or dying of a companion.

- This coverage additionally consists of concierge companies 24/7

Particular COVID-19 Protection:

- Cancel for Covid-19 Illness: If a visit is canceled or interrupted as a result of traveler contracting the virus, this plan can reimburse for pay as you go and non-refundable journey funds.

- Medical Protection for Covid-19: Consists of costs for hospitalization and working rooms use. This will likely additionally embody bills for a cruise ship cabin or a resort room when they’re really useful as an alternative choice to a hospital room.

Cons:

Ruby’s plan solely covers “pre-existing circumstances” when bought inside 14 days of journey deposit.

TravelSafe Insurance coverage

Greatest for all sorts of American vacationers with particularly advantages for golfers

TravelSafe Insurance coverage safety is particularly designed for American residents. Whether or not you’re touring domestically or overseas, this firm can help safe your journey, your valuables, and your journey companions.

Execs

- Nice match for all sorts of American vacationers with particular perks for golf lovers

- COVID-19 Protection – All its plans cowl COVID-19 have an amazing vary of COVID-19 associated bills.

- Protection restrict? Accessible till as much as US 500,0000 (circumstances apply)

- Really helpful by Forbes as probably the greatest medical insurance plans for 2022.

Particular COVID-19 protection options

COVID-19 is handled the identical as every other sickness for the needs of reimbursing losses incurred because of the sickness, together with dying.

Relying on the plan, this could embody however shouldn’t be restricted to:

- Journey Cancellation

- Journey Interruption

- Accident and Illness Medical Expense

- Emergency Medical Evacuation/ Medical Repatriation/ Return of Stay

Different Well being Protection

- Waiver of the exclusion for pre-existing medical circumstances

- Illness and accidents a medical bills (main protection)

- Emergency medical evacuation, medical repatriation, and return of stays

- Emergency evacuation for non-medical causes

- 24-hour unintended dying and dismemberment

- Non-obligatory air flight solely unintended dying and dismemberment

Different advantages – Protection for Belongings

- Baggage & Private Results – Having to exchange clothes and different private articles for as much as $2,500

- Baggage Delay – In case your baggage is delayed for greater than 12 hours, it’s coated as much as $250

- Non-obligatory Prolonged Private Property Pac is obtainable – Covers the expense of sports activities gear rental in case your checked sports activities gear is misplaced, stolen, broken, or delayed for greater than 12 hours by a typical provider.

- Non-obligatory Rental Automotive Injury is obtainable aside from Missouri residents.

- 24 Hour Worldwide Help Providers

Cons:

- Waiver of the Pre-Current Medical Situation Exclusion doesn’t embody residents from Florida, Missouri, Kansas, Virginia, and Washington.

The Protected Travels Voyager is greatest for vacationers of all ages and from all international locations, nevertheless it offers particular protection for seniors over the age of 69 who can’t acquire complete protection from different corporations.

This plan is for vacationers who need to shield their trip by having a excessive profit restrict. Protected Travels Voyager offers as much as $100,000 in journey cancellation protection in addition to $250,000 in predominant medical protection per individual.

Execs:

- The plan features a waiver for pre-existing medical circumstances if the plan is acquired earlier than to or with the ultimate journey fee.

- This plan additionally consists of $2,000 for doable lodging bills.

- COVID-19 medical bills could also be coated and handled underneath the emergency medical protection as every other sickness.

- The Cancel for Any Purpose (CFAR) possibility reimburses you for 75% of your journey prices.

- This plan meets the necessities for touring to Costa Rica.

Estimate for 2 senior vacationers occurring a 3-week journey to Europe

(Protection limits beneath are per individual)

- Journey Cancellation $3,650

- Journey Interruption $5,475

- Monetary Default 10 day wait if bought inside 21 days of Preliminary Journey Cost

- Terrorism in Itinerary Metropolis Overseas and U.S. Home

- Interrupt for Any Purpose

- Cancel for Any Purpose – 75% of non-refundable journey price [requires purchase within 21 days of Initial Trip Payment and certain conditions are met] (+$566.12)

- Baggage Loss – $2,500, $300 per article restrict, $500 mixed max. for specified gadgets

- Baggage Delay 8+ hours, $600 max.

- Journey Delay – 6+ hours, $150/day, $2,000 max.

- Trip Rental Injury

- Medical

- Medical Restrict $250,000

- Dental $750 included in Medical

- Pre-Current Circumstances

- Waiver If insurance coverage bought previous to or on the day of Remaining Journey Cost and sure circumstances are met

- Lookback Interval – 90 Days

- Unintentional Loss of life

- 24-Hr Full Protection $25,000

- Evacuation

- Medical Evacuation $1,000,000

- Repatriation of Stays $1,000,000

- Further Advantages

- Rental Automotive $35,000

- Included Advantages Pet Medical Expense – $250

- Missed Connection

Cons:

- The plan could also be a bit costly in comparison with others out there. For a 21-day journey to Europe, two senior People must pay some $809.06.

Tin Leg – Covid Insurance coverage for Vacationers

Tin Leg is reasonably priced journey insurance coverage that covers COVID-19.

Journey cancelation and journey interruption advantages are included in various COVID journey insurance policy provided by Tin Leg. Among the many many choices, the corporate affords are plans for journey vacationers and protection for the U.S. solely.

Within the occasion of a visit cancelation, Tin Leg’s normal plan pays 100% of coated journey bills (150% for journey interruption). Beneath these Journey Cancelation and Journey Interruption advantages, it’s possible you’ll cancel your trip for medical causes, together with a COVID -19 analysis.

COVID-19 Protection

You might be coated for those who check constructive for COVID earlier than or throughout your journey. As well as, Tin Leg pays if it is advisable postpone your journey to take care of a member of the family who received COVID again dwelling. For those who check constructive for COVID -19 and have to be quarantined earlier than returning dwelling, it’s possible you’ll be coated for as much as 7 days underneath your plan’s journey delay profit.

Execs:

- Zero deductibles

- offers round the clock emergency assist and covers COVID remedy.

- Getting the Cancel for Any Purpose improve will assure that you’re protected for journey advisories.

- Decrease protection limits

- You will have to pay your medical bills upfront and make a declare to get a reimbursement after your journey

Cons:

Verify costs right here!

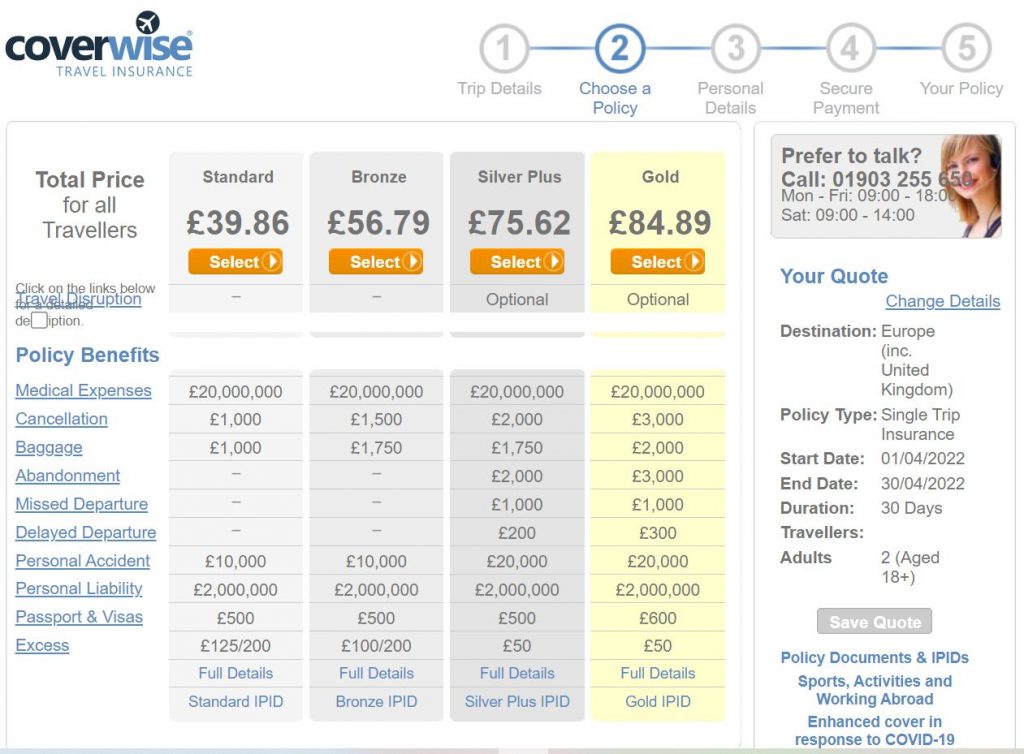

Coverwise is your best option for vacationers visiting European international locations together with the UK.

Earlier than you journey – They supply protection within the occasion you change into sick with COVID -19 and are unable to journey or have to quarantine.

Throughout your journey – All insurance policies cowl medical claims as a consequence of COVID -19 if there was not an (FCDO) warning towards the vacation spot.

Protection extends to affordable further transportation and/or lodging prices as much as the usual of your unique reserving (e.g., full or half board, all-inclusive, mattress and breakfast, self-catering room solely, and so on.

Execs

- Probably the most reasonably priced out there

- Protection of as much as Eur 23,979,000 for medical bills

Cons

- Increased missed departure profit is obtainable elsewhere however for the value continues to be beneficiant

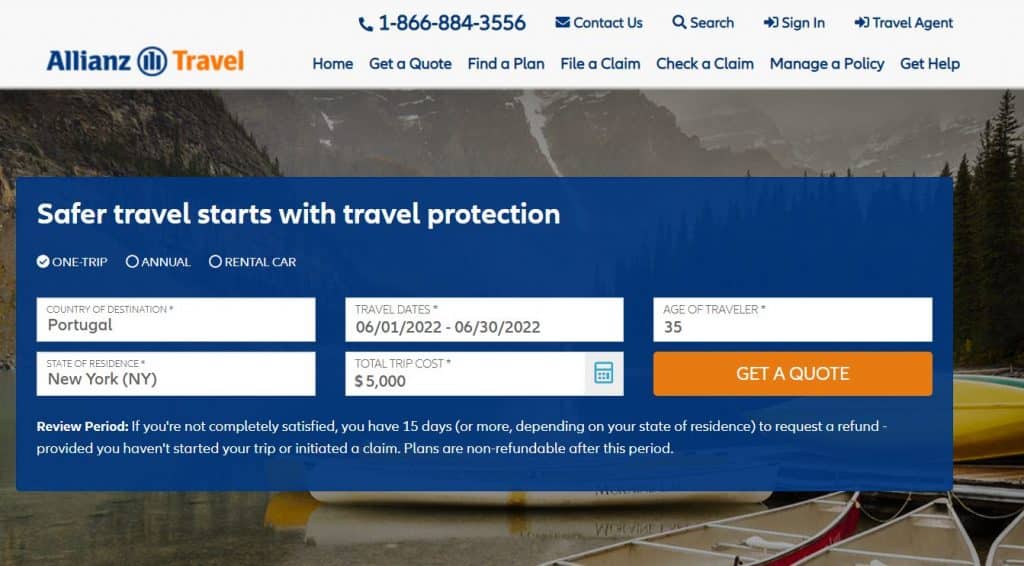

Allianz International Help

Allianz International Help is a complete insurance coverage protection that protects your journey funding, reimburses the price of medical emergencies and offers you 24/7 entry to help companies.

Execs:

- Journey cancelation: This journey insurance coverage could reimburse you for deliberate, non-refundable journey bills for those who should cancel your journey for a coated purpose.

- Medical emergencies: it may well enable you to get high quality care and reimburse you for coated medical bills.

- Journey delay: it’s possible you’ll be reimbursed for sure bills, reminiscent of resorts and meals.

- Knowledgeable help and recommendation is obtainable 24 hours a day, 7 days per week.

Particular Covid-19 protection

“Most of their plans now embody an pandemic Protection Endorsement, which provides epidemic-related coated causes for sure advantages.”

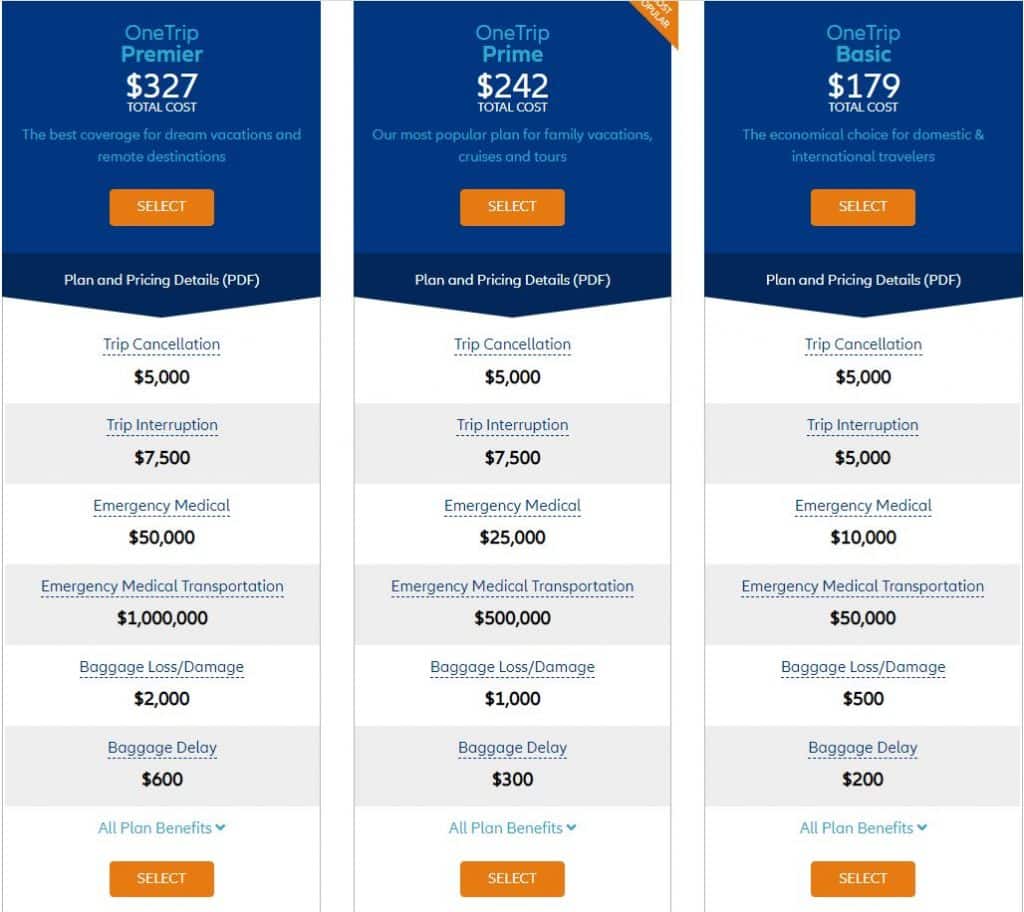

Think about considered one of these 3 superior plans

OneTrip Fundamental: with as much as $10,000 in journey cancelation and journey interruption insurance coverage and as much as $10,000 in emergency medical protection, it’s a favourite amongst finances vacationers.

OneTrip Prime covers issues like journey cancelation/interruption, medical emergencies, emergency transportation and journey delays, amongst different issues. When touring with a mum or dad or grandparent, youngsters underneath 17 are coated without cost.

OneTrip Premier affords essentially the most complete protection for journeys in faraway locations.

Cons:

- Covid-19 advantages could range by plan and placement and aren’t provided in all states. Please see the Protection Alert and COVID-19 FAQs for extra info.

- It’s barely extra expensive than comparable insurance policy available on the market. However the protection makes it price it.

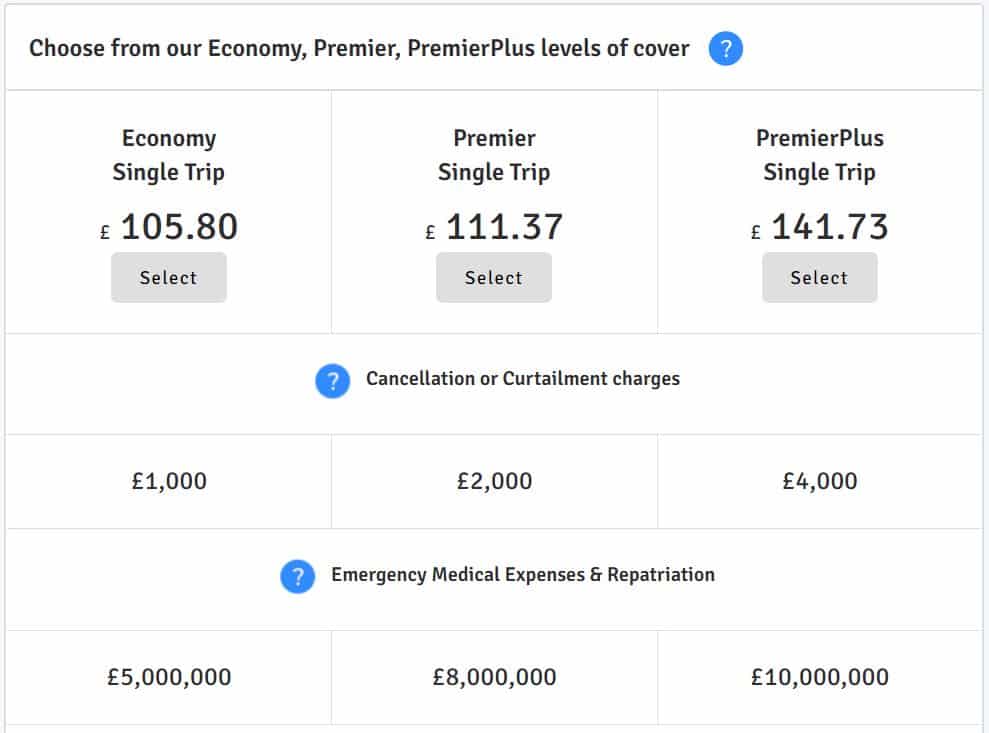

TravelTime Journey Insurance coverage

TravelTime Journey Insurance coverage focuses on Single Journey, Annual Multi-Journey, Winter Sports activities, and Backpacker journey insurance coverage at an amazing worth.

Their insurance policies cowl purchasers as much as and together with the age of 75, permitting you to conveniently and quickly choose and personalize your protection to match your particular wants.

Coronavirus protection

This low-cost insurance coverage pays for those who or somebody listed on the coverage turns into sick with Covid inside 14 days of your scheduled departure date and should cancel your journey. It additionally reimburses as much as £4,000 in cancelation prices towards a £99 deductible.

For those who contract the virus throughout your trip, you can be reimbursed for emergency medical remedy associated to Covid. Please observe that this solely applies if in case you have obtained all required Covid vaccinations (except your medical data present that you’re not eligible or exempt).

Additionally, you will be totally coated if you need to interrupt your trip as a consequence of Covid and return to the UK.

Learn the coverage’s full phrases and circumstances.

Get your quote right here!

HTH Worldwide

The TripProtector Most popular Plan from HTH affords luxurious advantages at a aggressive worth. This plan affords the best degree of medical and evacuation protection obtainable.

Moreover, this plan offers medical and evacuation caps of $500,000 or $1 million per individual.

In abstract, they supply a complete vary of journey medical insurance insurance policies that cowl medical evacuation, prescribed drugs, workplace visits, surgical procedure, and hospital care.

Journey with confidece, figuring out that you’ve easy accessibility to this community of respected English-speaking medical doctors in additional than 180 nations.

Quote for a 3-week journey of two vacationers aged 58 and 60 years outdated:

Observe(s):

“* This plan is designed for brief time period worldwide journey for leisure, instructional, missionary or enterprise journey.

* To enroll within the TravelGap Tour plan, you need to at the moment be enrolled in a main well being plan

* People on the identical TravelGap Single Journey coverage have to be relations. Unrelated people ought to enroll individually.”

COVID Safety Overview

- Accessible to US residents and residents who’re touring overseas and whose nation of residence is the US

- consists of $2000 in compensation for journey delays as a consequence of Covid quarantine and resorts stays.

- Journey interruption as much as 200% of journey price and journey cancellation as much as $50,000 every.

- affords $1,000,000 in medical transportation and $500,000 in medical for sickness and harm.

Cons:

Prices for plans will typically improve by 50% when a “cancel for any purpose” improve is added.

Get a quote right here!

COVID TRAVEL INSURANCE FAQs:

Yes, many of the insurance coverage corporations have a package deal that covers journey cancelation and one of many causes might be as a consequence of COVID-19.

If covid testing is said to remedy or hospitalization, your insurance coverage firm will cowl it. If testing is said to journey (as one of many necessities) to enter some nation, it most probably gained’t be coated.

Sure, if in your journey you’re going to get sick and you’ll have to quarantine, your insurance coverage will cowl additionally your quarantine. Double-check together with your insurance coverage firm.

Getting good COVID journey insurance coverage might be tough. Your insurance coverage firm could have instructed you that you’re, however there are such a lot of exceptions and “only-if” stipulations that you could be really not be coated in any respect.

We strongly advocate you improve or select a brand new plan that was designed having into consideration the numerous methods through which COVID can bitter your journey.

Journey insurance coverage normally covers your quarantine except quarantine extends the size of your journey and size of your insurance coverage.

We hope you’ve preferred this comparability of insurance coverage that covers COVID! We hope you’ve discovered an appropriate plan on your subsequent journey throughout these tough instances!

Tell us within the remark beneath if in case you have any recommendations, concepts or suggestions about insurance coverage COVID protection. We admire any sort of suggestions.