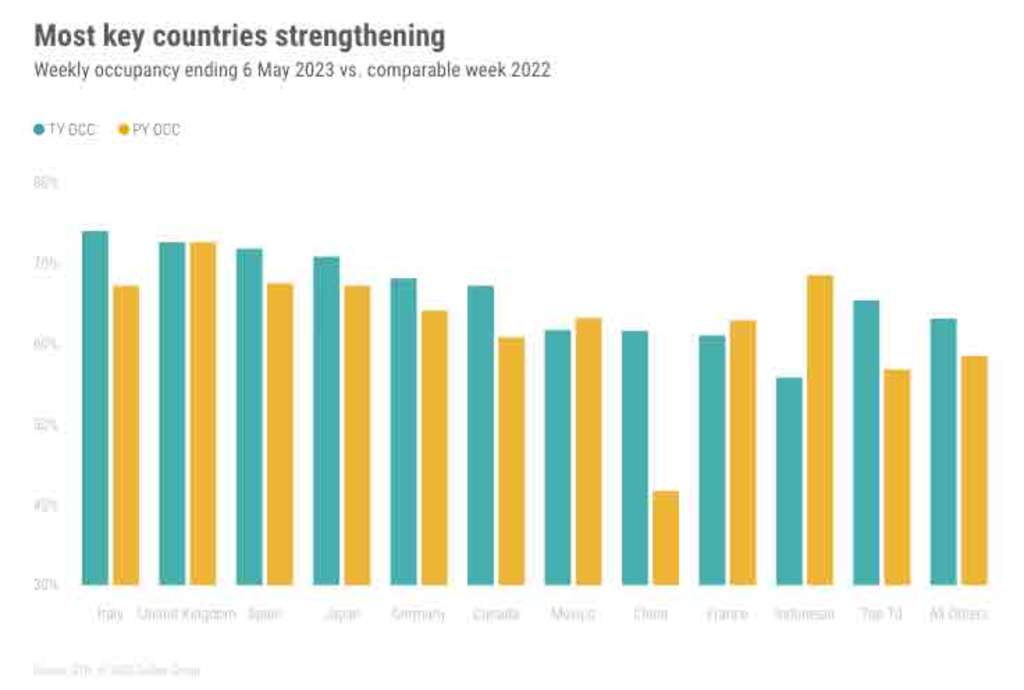

Nations included: United States, United Kingdom, Spain, Germany, Italy, China, Mexico, France, Canada, Japan, Indonesia, United Arab Emirates, Eire, Senegal, Fiji, Puerto Rico, and Lithuania.

U.S. Efficiency

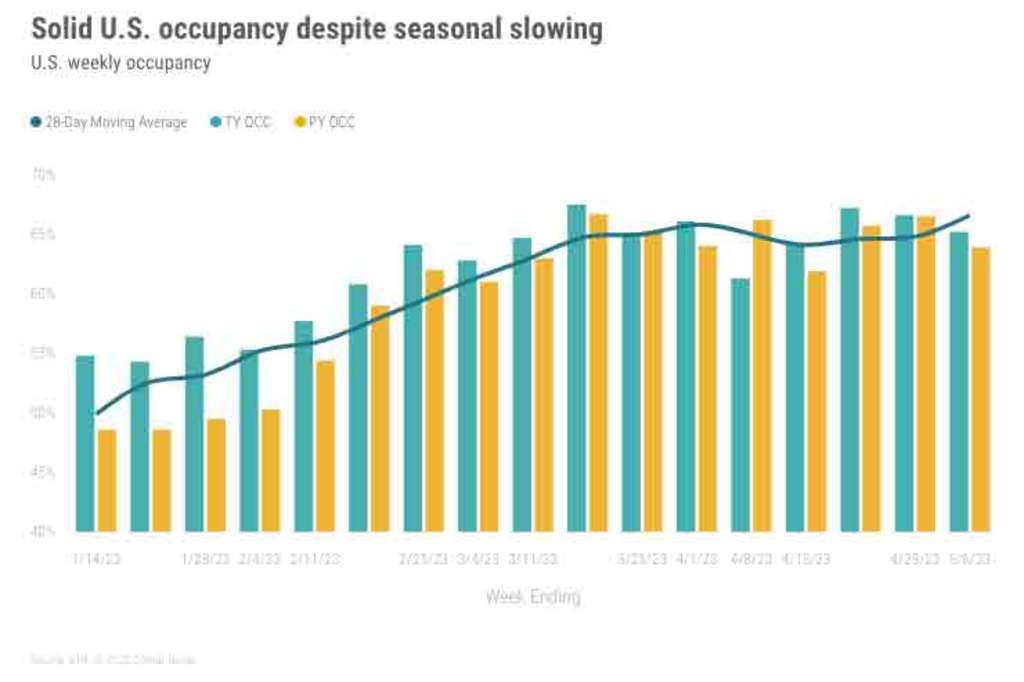

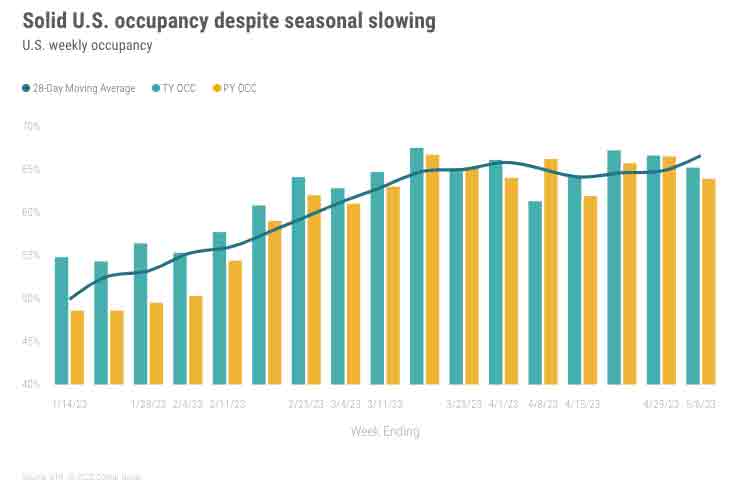

As we transfer into the interval between spring and the post-Memorial Day summer time kickoff, U.S. resort business occupancy confirmed an anticipated and modest decline of 1.4 proportion factors (ppts) from the prior week. Efficiency remained robust relative to final yr with occupancy of 65.2% rising 1.2 ppts from the matched week final yr. Vital to notice:

- There was a Mom’s Day calendar shift making a neater comp to final yr with Mom’s Day occurring one Sunday earlier in 2022. The other will happen within the subsequent week of information.

- Traditionally, Mom’s Day and the previous weekend produce barely decrease occupancy in comparison with the weekends earlier than and after Mom’s Day.

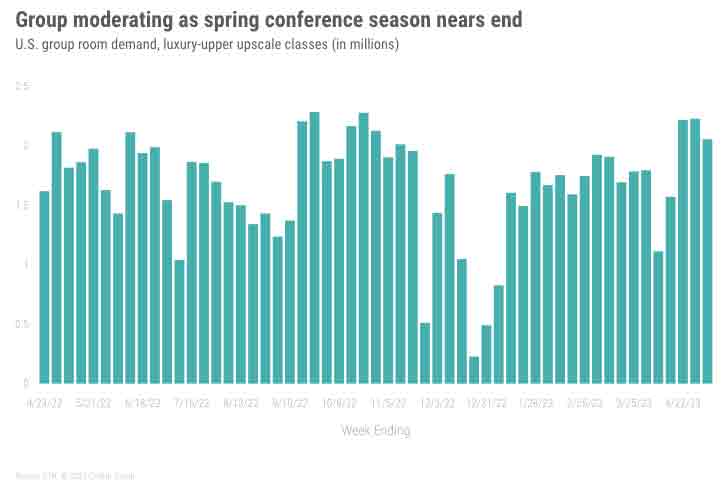

Group demand softened, whereas a number of notable occasions (Kentucky Derby, Miami’s Components One race, Taylor Swift’s Period Tour and, throughout the pond, King Charles’ coronation) impacted weekend transient demand.

Common every day price (ADR) at US$158 was US$1.48 increased than the prior week with a 6.4% improve yr over yr (YoY). The rise was simply forward of the tempo of the latest CPI-indexed annual inflation price (5.0%). Actual ADR (inflation-adjusted) was about 1% decrease than the 2019 comp after being in optimistic territory the prior fortnight.

With barely weaker occupancy, income per accessible room (RevPAR) fell US$1 week over week (WoW) to US$103. This minor decline was on par with historic seasonal patterns, and we anticipate extra variable weekly efficiency with some slower weeks headed into the Memorial Day vacation. U.S. RevPAR elevated a wholesome 8.4% YoY, comfortably forward of annual inflation.

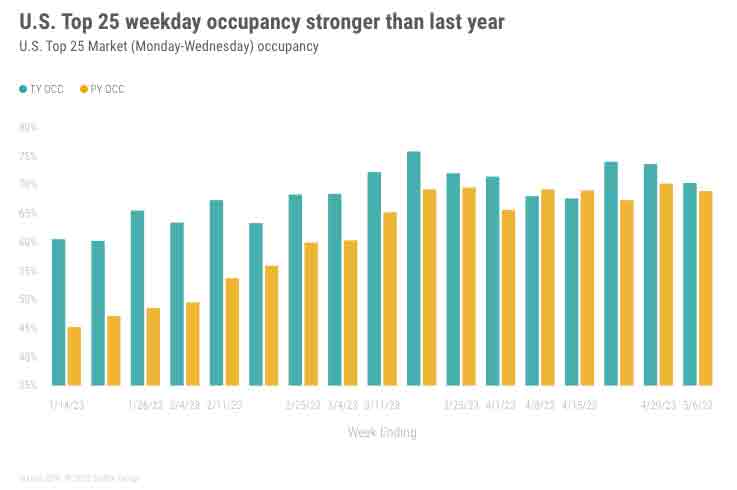

Day-of-week patterns confirmed above common WoW occupancy declines Monday via Thursday with improved occupancy on Saturday. Friday was mainly unchanged, and Sunday matched the typical decline. An extended-term comparability to the 2022 weekly comp exhibits weekends enhancing considerably, a reversal of the declining development seen in latest weeks, nonetheless, Mom’s Day being within the comparable week final yr possible had an affect. Weekdays in comparison with final yr improved barely. As in comparison with 2019, all three-day components (shoulder, weekday and weekend) have been at a deficit with the most important decline within the weekdays (-4.8ppts).

The U.S. Prime 25 Markets completed the week at 71.1% occupancy (-2.7 ppts WoW). A smaller weekly decline sample was seen in markets outdoors of the Prime 25 (-0.7 ppts WoW to 62.0%). In comparison with the identical interval final yr, the Prime 25 Markets elevated 2.1 ppts whereas all different markets elevated 0.7 ppts. Monday via Wednesday occupancy for the Prime 25 Markets elevated 1.4 ppts to 70.3%, whereas Friday via Saturday occupancy elevated a whopping 4.9 ppts to 78.7%, boosted by Chicago, Nashville, Philadelphia and others.

ADR for each the Prime 25 Markets (US$191) and all different markets (US$137) remained unchanged WoW. Of word, YoY progress charges in ADR gives one of many sharper distinctions between the Prime 25 Markets and non-Prime 25 locations with 8.4% ADR progress in Prime 25 vs. 4.3% progress in all different markets. The latter improve turns into a lower after factoring for inflation. One key distinction is that many smaller markets had already achieved or at the least got here near pricing-peaks by this time final yr as a result of robust leisure demand. In the meantime, many bigger markets for this era have been simply beginning to acquire demand (and pricing energy) via each a partial return of company journey but additionally some shifting leisure patterns.

For the fifth consecutive week, New York Metropolis led the Prime 25 Markets in occupancy at 85.1% (+8.4 ppts YoY), and town additionally posted the nation’s highest occupancy this because it did within the earlier week. Different occupancy leaders included Oahu at 80.2% (+8.7 ppt YoY), Anaheim at 75.2% (+6.1 ppts YoY) and Nashville at 76.5% (+3.1 ppts YoY). Nashville was buoyed by singer Taylor Swift’s three stadium exhibits:

- Weekend occupancy within the Nashville market was 94.2% with an ADR of US$318. Occupancy and ADR in downtown Nashville was 97.3% and US$571, respectively.

- In Atlanta, the place Swift carried out within the earlier week, weekend occupancy reached 81.8% with an ADR of US$162. Atlanta downtown, the place the live performance occurred, noticed occupancy of 90.8% and a US$320 ADR. This exhibits the affect the market dimension has on event-led occupancy as each exhibits had an identical variety of attendees.

- The tour strikes to Philadelphia and onto Boston the next week. A deeper dive into the resort efficiency throughout this tour is scheduled for the approaching weeks.

Two different main occasions occurred over the weekend.

- Miami hosted the Components One race, which spilled into one other week of information with the conclusion on Sunday, 7 Might. Occupancy in Miami on Saturday evening was 89.0% with an ADR of US$363.

- Louisville celebrated the 149th operating of the Kentucky Derby and bested each Miami and Nashville with an ADR of US$657. Weekend occupancy was 91.7%.

Segmentation

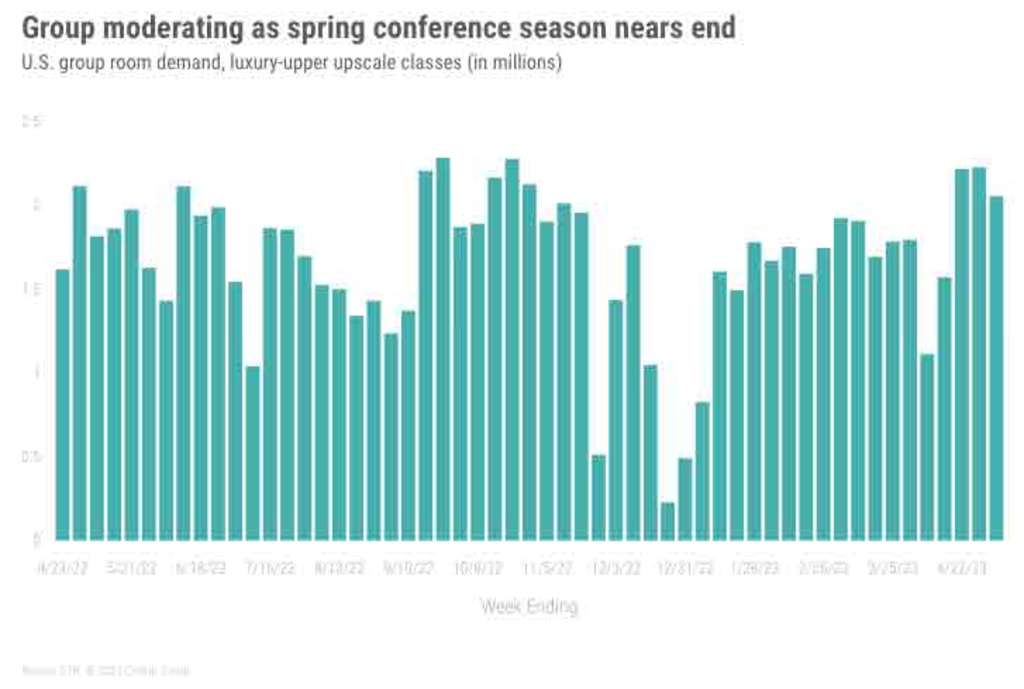

Group bookings at luxurious and higher upscale lodges softened with room evening demand dropping 7.7% WoW. Nonetheless, group bookings remained robust at 13.2% above final yr’s ranges. Transient bookings at luxurious and higher upscale lodges additionally softened 2.6% from the prior week however have been 1.3% above final yr’s ranges.

- Eighteen of the Prime 25 Markets skilled WoW group declines, whereas 14 of the Prime 25 Markets skilled a WoW transient decline.

- Strongest group markets week over week have been Los Angeles, Seattle, Miami, and Las Vegas.

- Strongest transient markets week over week have been Orlando, St. Louis, Boston, and New Orleans with a lift from Jazz Fest.

World Efficiency

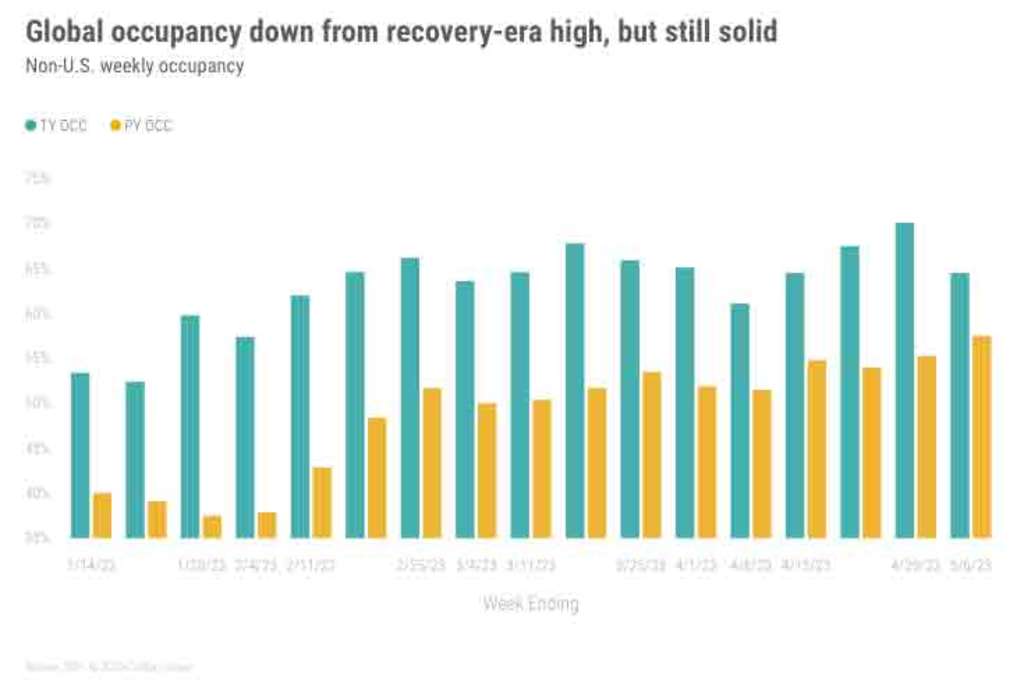

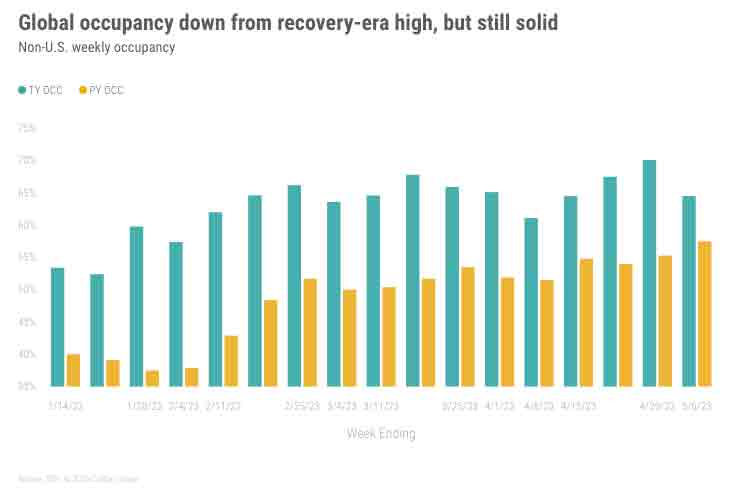

World occupancy, excluding the U.S., was 65.4%, declining 5.6ppts from the earlier week’s recovery-era excessive that was lifted by holidays throughout the globe, together with Eid al-Fitr and the Might Day vacation. The week’s stage was 7.1 ppts above the identical week final yr. Weekly ADR rose 18.9% YoY to US$148, leading to a RevPAR (US$95) improve of greater than 30% from final yr. Seasonal ups and downs are anticipated for the following couple weeks as we transfer nearer to the summer time holidays.

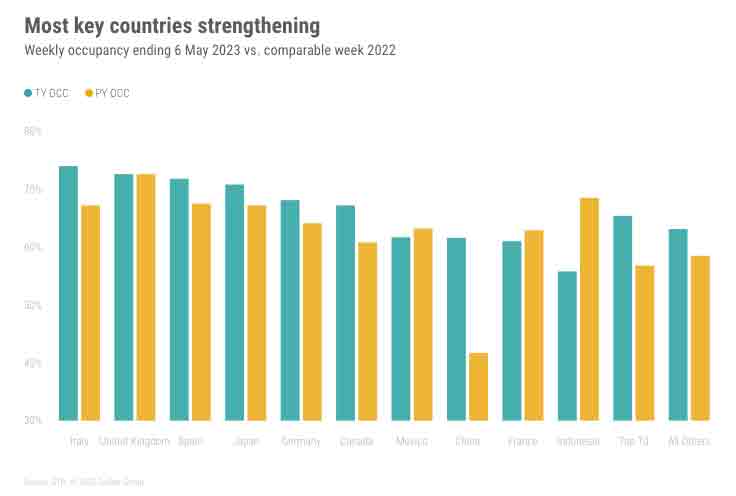

Among the many high 10 international locations based mostly on provide, occupancy was 63.1%, a decline from the restoration peak (70.1%) the earlier week. The week’s stage was up 7.1ppts YoY. Italy had the very best occupancy among the many high 10 at 74.0% and was adopted by the UK (72.6%). The biggest year-over-year occupancy acquire was seen in China (+19.9ppts), the place occupancy topped 61.6% however was down from a restoration peak three weeks in the past (74.2%). Week-over-week declines in Indonesia have been impacted by the Eid al-Fitr calendar.

The coronation of King Charles in London on 6 Might didn’t have a noticeable affect on resort efficiency throughout the UK. London ADR confirmed the best affect with a big improve whereas occupancy features have been extra muted.

Outdoors the ten largest provide international locations, a various set of nations posted occupancy above 78%, together with the United Arab Emirates, Eire, Senegal, Fiji, Puerto Rico, and Lithuania.

Ultimate ideas

Each U.S. and world outcomes have been impacted by regular seasonal slowing. Leisure journey stays robust and enterprise/company and group journey continues to ramp-up as we see persevering with features in weekday occupancy, notably within the largest markets. Likewise, the general mixture of journey seems to be shifting away from smaller markets and towards bigger markets. Bigger conventions and group occasions proceed to have larger affect on a broader vary of main markets. ADR remained firmly grounded with optimistic annual features, though the speed of ADR and RevPAR progress is moderating and can proceed to take action.

Trying forward

Efficiency subsequent week is predicted to plateau as we navigate the interval earlier than the summer time kickoff. School graduations will add to household journey, however that is anticipated to be offset by lessened leisure journey till households are free of college calendars. As we transfer nearer to the summer time season, leisure journey will strengthen, and group will average. Enterprise transient journey is predicted to proceed enhancing as is world efficiency.

About STR

STR gives premium information benchmarking, analytics and market insights for world hospitality sectors. Based in 1985, STR maintains a presence in 15 international locations with a North American headquarters in Hendersonville, Tennessee, a global headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a number one supplier of on-line actual property marketplaces, info and analytics within the industrial and residential property markets. For extra info, please go to str.com and costargroup.com.